Enjoying the Journey and Hoping for Humility

The truth, for us, is that markets have been kind. That we’ve been on the good side of the luck equation.

Enjoying the journey

This past year has been incredible for the PMS, and we close the financial year on a fairly positive note in terms of returns. Our active strategies outperformed the broad market index.

First, we start with something sombre: Don’t believe everything you hear.

The Ukraine-Russia war will hurt everything, they said.

Major events, minimal market impacts

Yes, there’s a war going on. Yes, crude prices rose to $130 a barrel. Yes, the world is seeing insane inflation. Yes, the Fed will raise interest rates like crazy, and so have the ECB, the central banks of Britain, Japan and even that of Russia. And India, too, did it, though a bit stealthily. Yes, China’s in a debilitating lockdown, where if you breathe too loudly, a drone will tell you how great Chinese history is, so please don’t breathe loudly. And there’s a crisis in Sri Lanka. In Pakistan, Imran Khan has “former” assigned to both his cricket and political status.

In all of this, if you had told me that the stock markets would be up 4% (from the end of Feb till the 14th of April), I would have laughed you out of the room.

Recently, in a conversation, someone said that Momentum should have gone to cash as soon as we heard that Russia invaded Ukraine. I wondered to myself: why? Momentum is up 8% since then!

Yet, it got me thinking; the same sort of issue happened in March 2020. Far more benign, in fact. Apart from some hospitals getting flooded in Italy, there wasn’t that much to worry about. We panicked really early, locked down the economy, and decided quickly that this virus affected western DNA more because as Indians we had natural immunity. Yet, India had one of the harshest lockdowns in the world, and continued to keep schools closed for nearly two years. When the virus finally came to us, we weren’t prepared enough, and the damage that occurred was devastating.

The worst part of the whole thing is what I’m going to tell you next. Virus or not, the Nifty was up during all that time that Delta ravaged through India (April to June 2021).

Financial markets are unpredictable. Once in a while, someone predicts something successfully and becomes a hero, but most predictions of market movements are by and large wrong. Acting on those predictions, even when the predictions are made by people in suits or bearing fancy degrees is a folly.

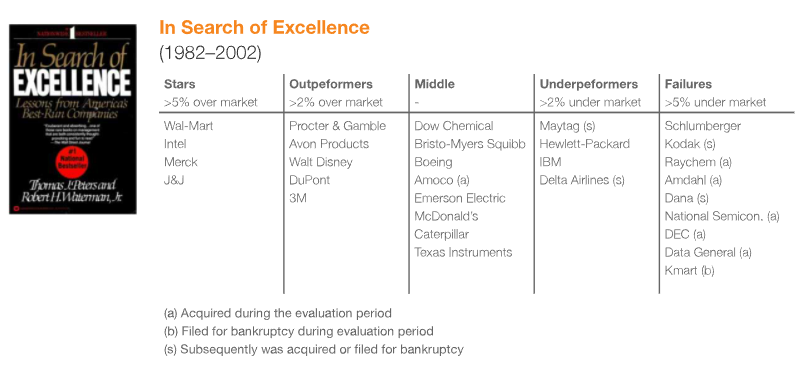

An example I recently heard about was much more in the past. The much-celebrated book, In search of excellence, was written by Tom Peters and Bob Waterman when they were employed with Mckinsey, in the late 1970s. They analysed a bunch of companies and decided that 32 of them were “excellent” because they had a bias to action, were hands on, stuck to the knitting, falana, dhimkaana.

McKinsey did us all a favour and analysed, in 2002, what these excellent companies were up to. Twenty years later, they were apparently not up to excellence.

And twenty years later, even the “Stars” on the left (Wal-mart, Intel, Merck, J&J) have majorly underperformed the S&P 500.

If, after twenty years, only 9 companies were able to deliver only 2% more than the market and, in fact, 9 companies failed entirely, these were not excellent companies. Even those that were excellent in 2002 are no longer excellent.

They were probably great companies in 1980, but the narratives that made them great according to Peters and Waterman were not “lasting” enough. They could have just been lucky, and attributed their successes to things like “a bias for action” which is like “a bias for having a pulse”, the reason we might attribute to the success of market participants in 2020-2022.

Tom Peters himself admitted that the book was an accidental find, and that excellence was hardly what they were searching for, that they constructed a narrative that was super against the beliefs of the time, and ‘found’ the data to support it. The book is still a great read, if you read it as “In search of what was once excellent but might not be, because the reasons for the excellence might not last, and we’re from McKinsey”.

That’s not the point, though. The point is that it’s incredibly difficult to identify anything that can survive the future. We expect something to, if it survived the past, especially if the reasons look good enough. However, real life changes too fast for those reasons to last, and the only thing that survives is the ability to react—admit your mistakes and change.

You can build a great narrative out of anything. If you give me a company and an excel sheet, I will build you a narrative backed with numbers. Anyone with the google search skills of a 5-year-old can do this, though the excel part takes a little bit more experience. You may have access, like Amit Varma said in our podcast together, to the internet and the history of everything, and yet you will react to what you heard in the last three days. I could say recency-bias colours your view of any company, of any strategy, and of any reason to invest right now; and it will sound good.

And you and I know this—so we have an internal “BS detector”. This allows us to be a little more sane. Often, with enough jargon, the BS detector is turned off. I mean if they said Hydroxychloroquine, we were fine until they told us no it’s terrible, and then we were not fine. (I did a lot of work to just cross-verify the data from 10 different papers last year: you can make whatever conclusion you want if you draw some strange little graphs, including saying it is likely to kill you, and it can save even your soul from COVID-19) Because of that, I’m a little jaded with any statements of absolute truth, even in markets – that we did excellently because we chose great companies with high ROE or quality, that we do deep research on management integrity, that our “backtest” will always work etc. At best you have a vague idea, and when you’re wrong, you admit it and react with change.

The truth, for us, is that markets have been kind. That we’ve been on the good side of the luck equation. Our job, however, is to continue doing the best we can to find great investing opportunities, and to be aware of the risks in them, and then, to change when that risk becomes real. This requires us to sometimes deviate from too much prediction, and move into what the data’s really telling us.

For example, the “unlock” theory - where things coming back to normal means that some businesses will benefit - is not universally true. While we’re being told that real estate will do well, the core data from RBI is clear: Bank credit to housing is growing at 6.5%, lowest since 2009. Will movies benefit, or airlines? Players in both have had to take on so much debt to keep themselves afloat that it will be at least three or four years before they can be healthy again. Hotels are the only ones showing signs of strength in the numbers (occupancy rates and bookings), and one of the better plays in that space took its place in both momentum and long-term multicap portfolios. Yet, this might be a narrative led game—like IRCTC was last year—and we have to be aware that the unexpected can, and will happen.

We are always in search of excellence (who isn’t?), but we’re also in search of data points that we are horribly wrong. Because nothing lasts forever. We’ve learnt to enjoy the journey more than to crib about the outcome. So, we would rather enjoy these excellent journeys for the days that they last, than to state that these will remain excellent forever.

To that end, the new financial year will create new journeys and wipe out others. Our hope is to come back next year and thank our lucky stars again. Our focus is to create many doors for opportunity to knock, and then open the right one.

Tax Loss Harvesting

Some of the gains we had last year were booked profits. The realisation of these profits mean that you will have to pay tax on them. One of the ways that Capitalmind has been innovating is decreasing the impact of these taxes, by using a tax-loss-harvesting technique. We do this in the Long Term Multicap portfolio.

We sell some stocks that currently have unrealized losses, and buy them back after a few days. This allows us to book those losses and thus reduce the taxable gains in this year, while still retaining the position in our portfolio.

We only do this in the Long Term Multicap portfolio. It’s a natural action in the Momentum portfolio, where losses are taken regularly as part of the algorithm. We do not override this through a temporary sell-and-buy-back, because it messes with the algorithm. In the market index portfolio, we hardly have much in terms of losses, so there’s no point harvesting any.

You can check the Tax P&L in Capitalmind Progress, and plan for payment of taxes accordingly, every quarter.

Here’s another quick note on dividends: Dividends are taxable in India, so any dividend you receive will be added to your income and taxed accordingly. If any company has paid you more than Rs. 5,000 in dividends in the financial year, it will deduct tax at source (TDS) which will appear in your TRACES statement at https://www.tdscpc.gov.in/ You can see the dividends you have received in your Tax P&L in Progress.

Here’s a few things you must be aware of:

- See your portfolio daily (Progress dashboard)

- Our disclosure document

- Our overall performance (all strategies)

- (anything else?)

Wishes on the New Financial Year,

Deepak