Happy New Year, Will 2021 Change Everything

What about 2021? Is it going to bring breakaway growth, breakaway inflation, a bitcoin to $100,000?

Happy New Year 2021 folk! One of those years that are worth forgetting for a few reasons, and worth remembering for others. But the next year, 2021, has very little to do to impress us. Just be a normal year and we’ll love you forever.

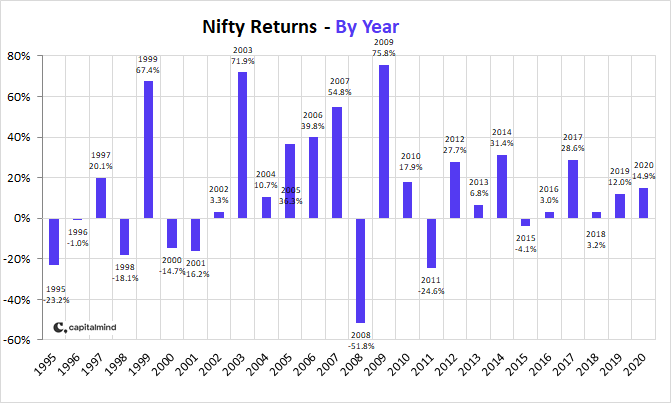

The markets, of course, have an incredible story to tell. The Nifty’s up 14% for the year, the fifth consecutive positive year in succession. The market hasn’t seen this many positive years since the massive run between 2002 to 2007. And truly, this year’s amazing because we saw a drop of 35% in March, and since then, markets have come back to make new highs.

What’s happened? Well, the central banks of the world have united to provide absolutely insane levels of liquidity. They’ve bought the least risky assets (their government bonds) and then even bought risky assets - Japan’s buying stocks, Europe is buying junk debt and so on. India too piled it on after a mini-debt crisis in March, followed by fall in bond values that crippled a debt mutual fund (Franklin). Since then, the RBI has cut interest rates and made money so easily available that even companies that were in serious trouble were able to raise funds at decent rates.

This phenomenon is worldwide, and now, in addition to the monetary stimulus of central banks pumping up rates, we are seeing direct benefits to households and businesses by western economies. The US has already done $2 trillion in relief, and has just voted for about $1trillion more. This is relief that’s more than India’s GDP - and India really doesn’t have the ability to do even 1/10th that much.

But India doesn’t seem to need it. Active and new case counts are reducing drastically, even as the economy opens up. Growth is slowly reappearing in credit numbers for banks. Credit growth had fallen to less than 4% a year, but in December it’s back up to 6%.

We haven’t made a big deal of it, but there’s an interesting phase shift - The Indian rupee may be steady against the dollar but it’s depreciated 10% against the Chinese Yuan Renminbi, this year. China has allowed its currency to appreciate, which has ramifications for India. Our imports from China are now 10% more expensive than pre-Covid, simply because of the exchange rate difference. That, and additional factors like import duties, push towards Import Substitution - the concept of buying locally simply because the imported things are more expensive.

Other pieces of data too seem to start showing improvements. Payment data shows a major increase in transactions using Debit cards and UPI: People use UPI for 400,000 cr. a month, double the pre-pandemic levels. Debit cards too, are seeing transactions of 100,000 cr. in POS (swiping at merchants or online) and about 250,000 cr. a month on ATMs to draw cash. In context, the total amount spent on credit cards is just Rs. 64,000 cr. in the most recent month.

The equity markets have been gung-ho in the last few weeks, scaling new heights, and while data is looking better, we believe that this is momentum season. Lots of stocks that are relatively richly valued continue to move up. The best performing sector for the year was Pharma - not surprisingly - followed closely by the IT pack. The worst, and this might even be a surprise - was banks, which as a whole are actually down for the year.

Foreign investors piled on 170,000 cr. into Indian equities this year. That’s after pulling out Rs. 60,000 cr. in March. The last two months have been huge: 120,000 cr. has been invested by foreign portfolio investors in November and December alone.

What about 2021? Is it going to bring breakaway growth, breakaway inflation, a bitcoin to $100,000? The Ravi Shastri quote is: “All three results are possible”. Much as we like to be conservative, this is likely to be a year of massive aggression. Because:

- The China currency appreciation will cause inflation in other countries, and in ours. However this won’t change central bank approaches to keeping rates low. Because of one simple thing: The fear of too much dependence on imports. Every country will want to use this opportunity to push their domestic industry forward, regardless of a little inflation.

- There’s another reason: the west cannot raise rates. They’ve put so much into the game, and they’ve done so much stimulus at the government level that if interest rates went up, the government budgets would be substantially stressed.

- Then there’s the political ramifications of hurting people’s retirement income which seems to now be more and more into stocks. Raise interest rates and you risk hurting large retirement corpuses.

- India can’t be raising rates, while everyone else keeps their cost of capital irrationally low. This means your FDs keep getting worse returns, and thus the feeling of wanting to put money into something that’s riskier.

- All the money that’s printed will find a small way to enter emerging markets, like they are today. The impact is disproportionate. That 120,000 crores I spoke of in November and December? That’s $16 billion. Tesla traded $140 billion in one single day. What’s coming to India looks big for us, but it’s a drop in the ocean in comparison to investment levels in the west.

- The fundamentals need to repair themselves, but there will be companies that will emerge super-strong from the crisis and break away on the upside.

The “Risk off” phenomenon isn’t going to be linear - there will be corrections. But at this time, it appears there’s a little more of the momentum to come our way. It’s when the vaccine is administered, when the health fears are totally behind us, that the markets will factor in anything but optimism.

In response, we’ll craft our strategy on equity to be more aggressive in the momentum strategy, and with more of the stronger stocks in the Multicap. We believe the best is still ahead of us, and in the long term, equity will do very well.

On the operational front, we are reviewing your PMS portfolios and writing to you as we go. If you have not heard from us yet, you will soon. Also, in the meantime, we will connect for the second PMS town hall meeting in two weeks. The tentative date is Jan 16th, 2021 (Saturday) around 11 am, you can block your calendars. We will soon send the invites to your inboxes.

It’s a new year, and we hope this one will be great for your personal, professional and financial life!

Welcomingly,

Deepak