The monsoon is here and it's not yet pouring

As the market recovers through resolution, lowered interest rates and liquidity, it will be the “good” that recovers first, just as the “bad” players go bust.

There’s a budget coming up in a few days. And there’s a slowdown in the overall economy. This took our GDP growth down to just 5.8%, a figure much lower than the 7% we are used to. Part of this is because of a troubled debt market; after the IL&FS default, non-bank lenders have found it incredibly difficult to find money to borrow, and therefore have stopped all forms of lending.

Imagine having gotten a home loan, and the lender refusing to pay the builder because they don’t have enough money. Even if the builder is in great financial shape, he can’t continue to build unless he gets part-payments, and when those aren’t forthcoming, he slows down construction. And that hurts everyone - mostly the home borrower, but also the builder’s suppliers, the interiors manufacturer, the contractors and so on. A similar story played out with the auto space, as both regulation (higher cost due to insurance and safety additions) and financing played a role. Auto sales have been down more than 10% in most auto players for the month of June.

Debt woes continue as more corporates hit the “default” button. Some of them were very highly leveraged. Some of them had taken loans and siphoned out the money. As this happens, the market tightens, and even good corporates reduce their need for borrowing. Credit growth has fallen across the board, and industrial credit growth stalled. Total loans given to industry are at the same level today as they were in January 2016 (Rs. 28 lakh crore) Banks haven’t anyhow been lending, because of high NPAs. Now even NBFCs have stopped, and corporates have cut borrowing. If there’s a classic indication of a slowdown, this is it.

But is there light at the end of the tunnel? There’s a strong reason to think so. This isn’t related to the budget - though a little government push may be helpful. It’s related more to what happens during any kind of crisis.

Once you move past denial, a government or a regulator will have to start taking action. Already, RBI has cut interest rates twice this year, and are likely to cut two more times. Money isn’t yet flowing, but at the rate they’re going, eventually it will. During this time, there’s a major clean-up operation in progress. Builders that are in trouble are selling their good properties to others that have the ability to take them over. Non-banking financiers, like DHFL, are selling their loans directly to help pay back their own debt, and banks are happy to now absorb them.

Foreign players, like CDPQ, Blackstone and Brookfield are actively bidding for stressed assets too. These deals waited for elections, and as expected, have been fast-tracked in the last month. This does two things - it crystallises any losses (or gains) for banks who lent against such assets, and is in effect “closure” - there’s less to worry about now. Secondly, it deleverages these sellers further and makes them stronger for the future.

In the backdrop, we have a much better regulatory system today in place. There are now liquidity buffers enforced even for non-banking companies, restrictions on share-backed lending by mutual funds and more disclosures for public companies. A new SEBI rule requires brokers to reduce unbridled leverage they could take using their customers’ securities after August 1. Rules are now in place that do not allow unregistered deposit taking, or “benami” transactions, and enforcement seems to be picking up.

As the market recovers through resolution, lowered interest rates and liquidity, it will be the “good” that recovers first, just as the “bad” players go bust. There will be collateral damage, but in general a strong player makes the most of such a crisis. Already, we’re seeing the dichotomy; just as the likes of Reliance Capital, DHFL and Yes Bank bite the dust, players like Bajaj Finance and even Manappuram are close to their highs.

Even the rhetoric of Donald Trump seems to be mellowing, with recent tweets showing signs of reconciliation. This, of course, depends on which side of the bed he’s woken on, but the hope remains that for all the chest-beating, he will settle for a negotiation and curtail the trade wars to where it doesn’t destroy the world. In the context of markets, the act of not destroying the world will be viewed as a good thing.

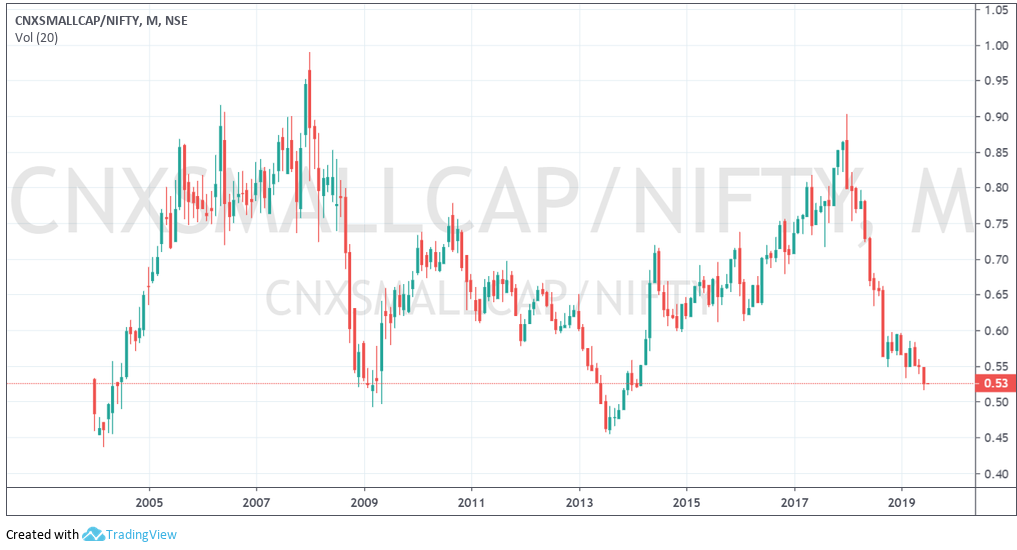

Meanwhile, we’ve seen markets being scared of anything that’s not large cap. The Nifty is close to highs and up 11% year on year, but the small cap index is 35% off the highs, and over 20% down in the last year. Midcaps are down 3% yoy. The difference is staggering. Yet, in a recovery, we expect the situation to reverse. Here’s a quick look at the ratio of the Small cap index to the Nifty - it’s at lows from which, in the past, we’ve seen strong recoveries.

Things could indeed get worse before they get better. But the key to long term investing is patience - things don’t stay lopsided forever.

Changes at Capitalmind Wealth

We’re changing our custodian to ICICI Securities, and will get back to you about the formality (a signature or so required) as things progress. There are no changes to fees, and no extra costs for this process. It will take a few days to change over, and we expect a period of no-activity of a few days when it actually happens, which is after we get all the forms etc. submitted (expecting end of July).

Many of you have been behind on your goals, partly because we have performed badly due to our focus on mid- and small-caps. I agree that our performance has sucked, and we should have been better, saying that even as I have a substantial portion of my own money and that of my family’s in the fund. And I think we’ll do better in the future, even if in the near term, we see more trouble in the markets. We’re actively hunting for new opportunities and will latch on to them as time progresses.

We now have three different strategies. Long term multicap is the oldest portfolio, and the two new ones are Momentum and Market Index. And you can see the stocks of each of them on Progress. Also, on the front page, you can see how your portfolio has changed from your investment to what you currently are at, with a split of fees, gains etc. Please do let us know your thoughts.

More on the Momentum portfolio (Click here) and Market Index (Click here)

I wish we get a budget that lowers our taxes and massively benefits the economy. However, it’s a six month budget for the most part, so we can’t expect any fireworks. It’s going to throw up more opportunities, and we remain committed to building better and greater portfolios for you.

Budgetedly,

Deepak Shenoy