April was lovely, and some thoughts on going Electric

India's past shows that either people expand too hard and too fast, or don't do it at all - both are extremes, and we look for a more measured approach.

April's been a good month. Markets went up. But that's not to say they won't go down again - and that's what's happened in May so far.

The deepest possible worries right now are in two areas: The US Dollar and the Indian bonds. These have nothing to do with stocks, we know. But eventually, they have everything to do with stocks. The US dollar is way past 67 and it's gone straight up in the last few months. India is, for the most part, an importer, specially of oil. And if those prices go up, we will see a rise in inflation.

Inflation leads to a rise in interest rates. But interest rates have already gone up. Even a rock-solid bank like HDFC bank is paying 7.85% in the bond markets for a one year borrowing, against levels of 6.6% in October, 6 months ago. They pay us lesser, because we are ordinary mortals. Bond markets demand, and get, what they believe the real interest rate should be.

As rates go up we should expect that markets will price equities lower. Because when you have to pay a higher interest rate on your borrowings, you will have lower profits left. This is of course longer term in nature, but with markets as overvalued as they are right now, it deserves a little more care.

Thinking long term will also mean that at some point there is short term pain that will happen - and we believe much of this year will have that pain.

Having said that, we want to dwell more on how we're tackling the way forward. One of our themes is the Electric Vehicle theme, and we're really excited about it.

The nature of an EV Beast

We've been looking at electric vehicles with surprise. After Tesla, there's now a ton of manufacturers looking to build better and bigger electric cars. Porsche even has a model coming that will have the same price - around $85,000 - as a higher end Tesla and then, it's a Porsche. With contactless battery charging and what not. Tesla may not win, but it'll surely be a win for the electric transportation industry.

In India this phenomenon is likely to see traction from the small car and the bike segment, not necessarily the large cars alone. And it'll likely come into public transport buses early. And this is big because electric vehicles have a higher power and much lower longer term cost (of fuel) and also a much lower pollution footprint. And most importantly, it's likely to be much cheaper to run and maintain a car. But things will get obsolete if we go electric.

Meaning: No pistons. No sprockets and chains in two-wheelers. No exhaust pipes. No fuel injectors. No differentials, no transmissions, and no lubricants. Because you don't need all of these.

Even service. Car dealers thrive on a service every six months. With 80% less moving parts, that's a much lower service requirement too. Existing revenue models for a lot of players will need to change.

But you'll still need headlamps. And wires. And motors. And axles. And suspensions. We have been trying to build our longer term auto portfolio based on our thoughts around one thing: who will survive?

We have some of the companies today. We'll add more of the players tomorrow as they show us more. We even have interesting ancilliaries in there, such as a company (Gravita) that currently recycles lead acid batteries and sells the lead to battery manufacturers - one day, when we get enough battery tech but won't have enough Nickel/Manganese/Cobalt, we'll have to recyle batteries to get them out. And these guys might just be able to do that.

There's even the falling BPCL. It's an oil refiner, and that too a public sector one. And it's a rough season for oil prices. And it's been falling, because it's got some political line of connection that disallows increase in oil prices. However, in the longer term I believe a few things will happen:

Real deregulation will allow them to set prices as they like Development of real estate they own - because, hey, petrol pumps - will allow them retail expansion in a broader sense. From being sources of supply for quick snacks (currently) to ecom distribution points, to all night stores etc. Electric recharging: petrol pumps all over the country have one thing: electricity. Because, hey, generators need diesel and that's abundant at a petrol station. You can use that electricity for recharging vehicles - especially when electric becomes a standard. Of the three PSU oil marketing companies, BPCL has the biggest chance of being privatized. Not now, but in the next decade.

The idea is to buy at a relatively low valuation. And currently at sub-9 times earnings, they're not too expensive. Debt is relatively low too - and they have some Rs. 10,000 cr. in deposits for LPG cylinders, on which they pay no interest. There's a bit of an EV play here, but the idea is get in cheap, and wait for the triggers to set in.

We also liked a Sasken and Tata Elxsi whose EV plays are minor but at least they've built some expertise in the areas of automated driving, sensor management and engine control mechanics. There's some scope from this going forward, built as service offerings.

But we've not gotten into battery makers yet. And we've not seen much of the auto cycle move into electric just yet. But as this scales, we'll find more interesting stocks to buy.

From a general market standpoint, the focus has to be on industrials and export led sectors. The industrial performance - in specific industries - has been incredibly good, going by early results. Exports will do well in a rising dollar environment. However, the long term sustainability of this growth is only if they use this time to scale - organically or inorganically - and to build bigger and wider businesses, rather than to just hold on to profits in cash. India's past shows that either people expand too hard and too fast, or don't do it at all - both are extremes, and we look for a more measured approach.

The New Progress

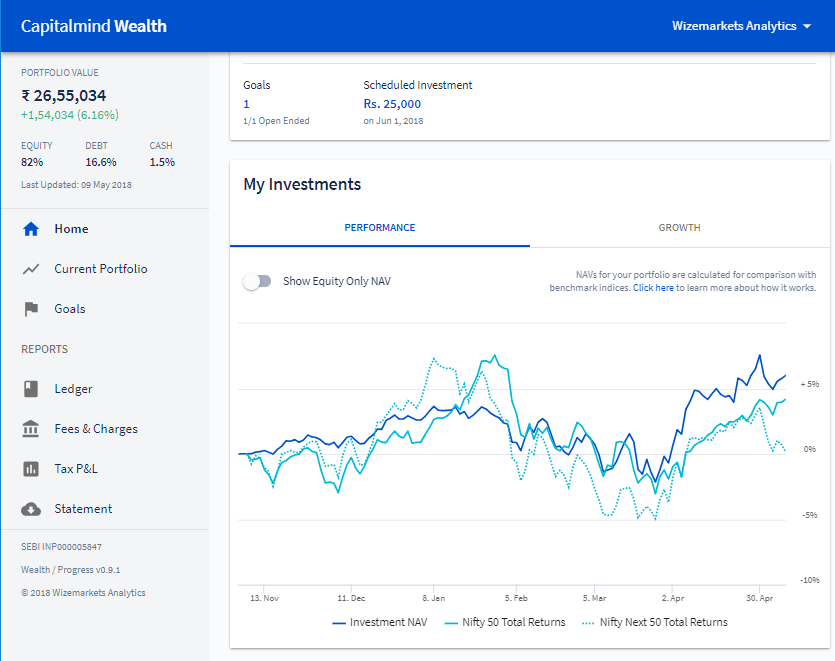

We have a New Progress Site for you. It's a lovely new simple design. You can see your portfolio holdings in one place, updated with a day's lag.

You can also see a bunch of things - how your portfolio has performed, compared with indexes. How your goals are doing compared to where they should be. Losses and gains on each stock or debt fund. And even tax statements and fees.

And note that this is an actual statement. Wizemarkets Analytics is actually the first customer of Capitalmind Wealth, and we started with 25 lakh. This is the real performance of the portfolio from Day 1 - and we've done a little more than 6% since November, while indexes have done a bit lesser. It's decent but nowhere close to "enough" - that will still take some time.

We're constantly upgrading this site and will add more features, and thanks to many of you who've given us very detailed feedback! Please do mail us for more comments.

Much about investing is about building a hypothesis for each stock you own, and continuously investing in those stocks as long as they're sticking to that path. At many times, there will be a question: should I give this stock more time? Or is it better to move on? There is no single answer, but our approach to each of these stocks is to see if something fundamental has changed, and changed enough to invalidate our hypothesis. And to take action when it has, or to consciously ignore it when it hasn't. Sometimes the best thing to do is to do nothing.

Let's hope for a great year ahead. Whether cars are electric or the dollar is eclectic, there will be more opportunities to find and rewards to aim for!

EV-erjoyingly,

Deepak Shenoy