Happy Diwali and One Year On

The market now appears extremely frightened, with even a mention of IL&FS, a stock would fall 10%. And anyone that even had good results got beaten up. This has been a crisis of confidence, but what is the reality?

It's November, and this time, the month of Diwali! Wish you a very Happy Festival of Lights! It's also approximately one year since we've launched and we have seen a good share of volatility to go with it.

Things in the market have been crazy. In September we have seen a massive scare in the form of a large entity, IL&FS, defaulting on its debt. India has been relatively benign in terms of institutional failure. Meaning, the big boys usually pay back their debt. Somehow or the other. So when IL&FS couldn't, and it seems like they can't pay up in full and it's going to take time, all hell broke loose. But before this gets all technical, let us look at India's "shadow banking" system.

The Shadow Banks

The traditional idea is: you put money in a bank. Let's assume there's only one bank in town. That bank then lends money to a company. The company puts that money into the same bank. The bank then lends it out again. This stuff can easily get out of hand. Because at some point the bank has borrowed from a 100 people and lent to a 100 people and if one person doesn't pay back a loan, the entire system is broken. So banks are regulated how many times they can "rotate" the money they have, with maximum leverage and capital ratios. And then banks have to have some portion of money in cash. And some other portion in government bonds. And further more easytosell things because of something called a "Liquidity Coverage Ratio" (read our post). This is all fine.

Banks make a lot of money. But they also are tremendously slow to react and require onerous levels of documentation for everything. There are people lots of people who don't get access to bank loans because of documentation pains, like not having an address or income proof. Yet, they are willing to offer collateral such as gold for their loans, but banks won't service them. So, in comes a nonbank lender, like Manappuram Finance (who finances against Gold) or Hero Finance (who finances motorcycle purchases). These are the famed NBFCs.

Where do nonbanks get money from? Typically they borrow from banks. That isn't bad per se. Banks have to lend anyhow. And NBFCs give them some diversification.

But NBFCs can also borrow from you and me directly. Or through mutual funds that we invest in. Technically you could buy a mutual fund, the mutual fund then lends money to an NBFC, and then the NBFC loans money to a corporate or to an individual, who can then buy more mutual funds etc. This is a cycle that doesn't involve banks. Hence, "shadow banking".

It's not bad and exists everywhere. Heck, even a money lender that accepts deposits is a shadow bank in some form. But there are larger risks here. Lending directly to a corporate through a mutual fund means you shoulder the risk. Meaning, if the corporate doesn't pay, it's your problem. Whereas if you put money in a bank and the bank gives it to a corporate, a default is the bank's problem, not yours, unless the bank goes bust.

Just look at what happened. IL&FS defaulted, and even through people knew that it was in trouble, no one expected an actual default. When it happened, many debt mutual funds lost that money and thus their NAV dropped. When that happened, investors didn't like it because hey, a debt mutual fund isn't supposed to do that. Or is it? Most people didn't realise they were, effectively, shouldering risk, because there was no problem in the last five years.

Wait, 5 years?

5 years ago, the RBI raised rates overnight, and liquid funds lost money. Not a huge amount (about 0.2%) but that was still a scare.

Then there was Deccan Chronicle, which defaulted on paying a few mutual funds in 2013 and that was absorbed because the promoters of the mutual funds took it on their own books. Again, Jindal Steel bonds saw a downgrade, and a mutual fund that held them passed the loss to the fund investors, but made it up in a short while. Then there was a big default by Amtek Auto which hit a mutual fund so hard that investors took a big hit and the AMC sold its operations.

There have been such crises at mutual funds regularly. And we've come out of each one reasonably well, and soon. Of course, if something like Lehman happens, we will be hurt but IL&FS is hardly a Lehman size even for our comparatively small economy.

Currently too, we're seeing people spooked by the NBFC situation and refusing to lend to them. Corporates took away money from mutual funds. Which didn't have money to lend to NBFCs, so the NBFCs went to banks instead. Banks said wait, or simply, no. NBFCs then said okay lets slow our growth down until money is easier to get. And over the last few weeks they have slowly found the market stabilising and starting to go in their favour again.

The USD spiked to above 74.5 but is now down below Rs. 73. Yields of bonds have fallen from the 8%+ levels we saw a few weeks back, to 7.8% now. We've seen mutual funds slowly start to lend to NBFCs again in fact, just today, over 17,000 Cr of commercial paper was issued, and a good portion to NBFCs.

What gets really bad will also get fixed the markets love to revert to the mean.

The Stock Market

The market now appears extremely frightened, with even a mention of IL&FS, a stock would fall 10%. And anyone that even had good results got beaten up. This has been a crisis of confidence, but what is the reality?

The answer on the results front looks much better. We have about 35 companies on our list,and more than 100 that we are watching. On aggregate, we've seen earnings growth of more than 20% in them. Specific companies that have fallen to half or so have profits doubling or more.

The Nifty itself is looking like it's going to a growth phase. We tabulated consolidated P/E ratios of the index (what they reveal is the standalone numbers, which doesn't include subsidiaries). That number had fallen below 20 a few days back. Earnings growth seems much better overall, and we're seeing some incredibly good numbers even from NBFCs.

Foreign investors have sold a record 67,000 Cr in October, with 28,000 Cr in equity markets alone. That is the biggest number in over 10 years, with the second largest (in equity) being 18,000 Cr in November 2016. The biggest sales are fire sales when everything must go, at any price.

Our View: Longer Term Recovery Of Stock Prices

We've been of the opinion that markets were overvalued. Some stocks still are. But by and large, stocks have corrected substantially and now provide a much better opportunity.

In the long term, India's markets are likely to rise a lot more. If that view is correct, then every time that valuations look reasonable, we should be buyers. We've started to accelerate the deployment into equity, and you would have noticed that we sold some debt funds in your accounts last month. We'll sell some more this month as we look to add more positions and average in.

We expect volatility to last till endDecember or January, so we won't go all in now, but are increasing allocations till then.

The Exposure to the US market

We use Google and Apple and Microsoft. And Twitter and Facebook. And this is a good portion of our lives, but we don't get any benefit from being stockholders in them.

At Capitalmind we've wanted to change that, and have an exposure to these stocks. But the only ETF available to us, the Nasdaq 100 ETF, was priced at an abnormal price in the market (20% higher than the NAV!). This is a market inefficiency we cannot explain.

So, this month, we will be adding Nasdaq 100 ETF units to your account, at between 2% and 3% of your equity portfolios. This has been purchased at an NAV directly from the mutual fund AMC, and because the market is inefficient, you might notice the position showing 15% profit almost instantly. While that is a good thing, it might not last too long because the inefficiency will go away eventually. However, it's a good 15% cushion to have! And in a little way, things like this ensure that we keep working to earn our fees.

Happy Diwali, and One Year On

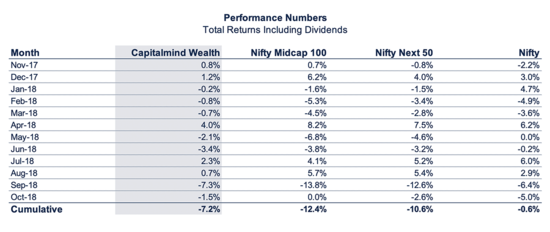

And again, a very Happy Diwali and Festive Season from all of us at Capitalmind! It's been a very interesting year and we'll soon be publishing our performance numbers. In short, the weighted average return has been a negative 7% or so, but other than the Nifty we've done better than others. This is net of fees and charges.

This may be different from your portfolio, as this is an average weighted number, and it includes the debt returns on the cash allocations. We hope to see a much better return going forward as the market recovers and stock earnings take higher precedence than fear. We're confident that our stocks will provide great long term returns and help you reach your goals in the coming years.

Optimistically,

Deepak Shenoy