The Market Fall and Why We Find It Exciting To Buy

Remember, when debt markets provide yields of 10%+ based almost entirely on fear, and markets take some stocks to levels below the cash they hold, you know that the market's being, perhaps, a little too cautious.

September has been a brutal month for portfolios. And all that caution we have been warning about is now playing up, even if the trouble started in a place that wasn't entirely expected: the debt markets. There's this company called IL&FS that saw a default in the money markets, where it was rated AAA (the most pristine) and went from there to D (the lowest possible) in two weeks.

Note: An IL&FS company, IL&FS Securities, was our custodian at Capitalmind Wealth. This has now been sold to Indusind Bank (which has confirmed the complete transfer when it finally got SEBI approval). So there's no direct impact to us from the debt situation.

The trouble with IL&FS? That it has long maturity investments, like roads and power projects. It borrowed shorter term loans, mostly because long term finance was not available, but also because markets were super-accomodative, and allowed them to borrow at low costs. When they couldn't pay back, it was mostly because they couldn't arrange to roll over the shorter term borrowing.

Put simply, it's like paying for your house with a 1 year loan, and because you actually want to pay over 20 years, taking a new 1 year loan every year and paying back the old one. At some point,if you can't take a new loan, you still have to pay the old one, and boom, you default. When you default, everyone knows you've defaulted, and no one lends you fresh money. At this point, your only hope is to find someone else you can borrow from that trusts you, or sell the house. For houses, it may still be possible - the house obviously has some value. But a road project will create value in the future, and there aren't that many people willing to buy it or refinance it that easily.

In debt markets, this creates a lot of tension. If one company defaults, then there's a cascade of issues. Imagine a mutual fund had bought some IL&FS debt which didn't pay out. It doesn't mean IL&FS will NEVER pay - there is indeed a plan to pay back but will take some more time. (We'll come to that) This does mean, however, that currently the mutual fund does not receive the money.

Meanwhile there are investors in the mutual fund - what happens if they want to withdraw money, even some part of it? If the mutual fund owns bonds from 10 companies, then it has to sell some of the other 9 in order to receive money. And now, since the market is scared, there aren't enough people to buy those bonds either, and prices fall.

This has a cascading impact that can derail fund raising even by good companies. The regulators usually keep a watch on this and make adjustments : for instance, in some cases, mutual funds have been given loans by RBI against their investments, to provide for cash so that they don't have to sell in the market to meet redemptions. This is likely to happen again to ease any pressure.

So What's Really Happened?

IL&FS has defaulted on a ton of paper that was due in September. Many mutual funds have marked that down between 25% and 100% on the paper they hold, so that they can meet redemptions with the rest of their investments. September is a heavy redemption month due to advance tax numbers - so there is a need for cash anyhow.

However, on Saturday (Sep 29) the IL&FS board met and investors in it have agreed to put in Rs. 4,500 cr. of equity. That will improve their debt profile, allow them to pay back the money markets and mutual funds, and negotiate selling of their assets for longer term debt.

Debt markets have calmed down already, through yields are still a little high. The RBI is expected to raise interest rates next week as well, and they're ready to provide emergency liquidity. Still, there is a fear that debt markets will be hurt for a while, and yields remain elevated.

- We invest partially in debt funds - mostly short-term. We will continue to analyze portfolios and look to derisk by using safer liquid funds, because yields of even liquids are greater than 7% now. *

The Equity Markets

We've seen a major fall in the equity markets. 8% on the Nifty in September, and 12% of the Nifty Junior. Much of this has reasons - from RBI beating up Yes Bank, IL&FS's default, to rise in petrol prices, to the fall in the rupee, to what not. But markets had gone up too fast, and were richly valued - that overvaluation is correcting. We've warned about this earlier, but our action was to buy slowly and while we have exposure, we can finally find stocks at better valuations.

Having said that, is the fall over? Probably not. It's not useful to predict when, because just as markets go to an extreme on the way up, they could head to an extreme on the way down. What comforts us is that valuations on some select stocks - including the ones we own - have settled down to more acceptable levels. The small cap index is down 36% from the peak, and the midcap index, about 22%.(See our post explaining this context)

The US has started to increase rates and cut liquidity. All emerging markets have been beaten up - even China's down 10%. But just as we say that, it's obvious that a few things have been in India's favour. Inflation is still at a reasonable 4% or so, and interest rates, for the most part, are about 7.5% - for the first time in many years, we have solid real rates. Growth remains strong - from all metrics, companies remain quite positive, and promoters have even started buying their stocks in the dip. It may still be early, but the signs of "green shoots" are beginning to be visible, especially in the context of an investor that is now paying even lower prices to enter.

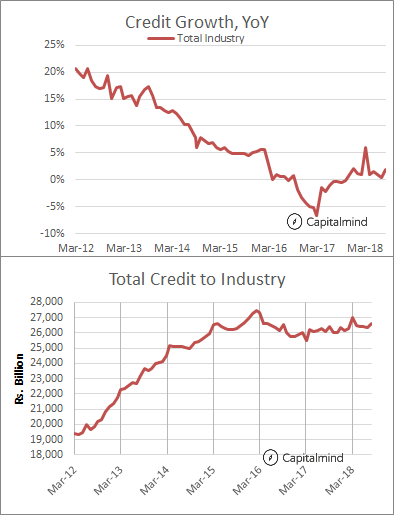

India's Corporate Leverage has also reduced substantially. Credit to Industry has remained stagnant since 2015, and growth has slowly fixed the overleveraged situation here.

Unlike much of the west, India doesn't have the problem of low interest rates and cheap money - everything we do competes with a 7.5% risk-free Fixed Deposit. With low inflation, growth is more "real" than in the earlier decade. As bearish as I might be about the western world's cheap money and extreme leverage in Japan and Europe, I think India's story isn't quite as bad - and indeed, there's more value now that the valuations have corrected.

We believe this is a great time to add positions to the market - like last month, we will be redeeming some of the debt in your portfolios and moving the money into stocks. We will accelerate deployment but still, we expect weakness till December at least, and will spread out the investment till then.

Our Stocks

Our stock portfolio has been hurt badly, and we expect some of it to get worse. We have a quick update on the stocks we own. We have more than 30 stocks, and believe that diversification is important - eventually, in a few years, the portfolio will have a bulk of its position in possibly just 10 stocks, but when we start, we'll take more positions and add to the winners over time.

IT and Technology: We like the engineering outsourcing spaces, where Tata Elxsi and LTTS are good players. Also a small cap tech player in Sasken gives us a boost for the longer term. Corrections in these stocks, we believe, make their valuations even more attractive.

Inorganic plays: Quess and Naukri are in this camp, where their investments and acquisitions give us the longer term scale. In a few years, we believe both will be much bigger in size than they are currently.

The auto sector: We are quite gung-ho on this sector in general. Maruti in Cars and Hero Motocorp in 2 Wheelers are market leaders and have no debt; Hero has in fact fallen to very attractive P/E levels, and has Rs. 5,000 cr. in cash. With commercial vehicles, we find the OEM suppliers are likely to benefit the most - Jamna and GNA Axles are leaders in their spaces. Suprajit Engineering is a relatively small cable company with a reasonably large export component and that should benefit as well. We also have a presence in the exporter at Balkrishna Industries (for off road tyres). India, in the long term, will see massive expansions in all three sectors (2 wheelers, Passenger cars, and Commercial vehicles) and we intend to participate even more at lower levels.

Infrastructure: There's a KNR Constructions, an efficient road builder. Beaten up recently by fears we feel are overdone, as it continues to be able to achieve financial closure on more projects than others, and push up execution. One play that has seen serious damage recently is Kridhan, but we're holding off on further buying till more clarity emerges on their recent acquisitions; here, there's some comfort in that Singapore government continuing to own a sizeable position. Some of the other infra players like Indian Hume have been beaten down, though we continue to believe in their long term ability to execute water and sanitation projects.

Financials: This is a sector hit badly recently, and much of that is because of the drama in debt markets. Our financial stocks include the gold lender Manappuram and commercial vehicle financial Shriram Transport. Both of them lend at higher interest rates and a 1% rise in input rates will not hurt them too long. The likes of JM Financial will only benefit in the longer term when asset recoveries start, and our bet here is small and will grow only as the financials show their impact. We also have three banks as a broad bet - two smartly growing private sector banks, and a public sector Indian Bank that has been hit recently, but we believe has the best metrics in the sector. Yes, there's a fear of a bank merger but even then our analysis says this price is good enough to hold.

The others: We like JK Paper, which is likely to show a solid growth in the medium term as paper demand is more domestic now (since the USD has risen), and they expand capacities and integrate the company they've managed to acquire in the NCLT bankruptcy process.

Unichem is a pharma bet valued at near-cash levels, and will benefit from the rupee, as will a more efficient Jubilant Life. Sanofi and Abbott are MNC healthcare plays that should do very well as the Indian medical sector grows.

There are a small set of players where we've been a little worried and this will see some exits once we see how results pan out. There's no reason to be married to a stock but you have to give a thesis some time to run through.

We'll change positions as markets change - if they fall a lot, more stocks become attractive, and we might see new players become attractive. We'll replace or add stocks as the market evolves.

This still remains a great time to invest, but it's also true that stocks can fall much further before they rebound. We build confidence through diversification, and through spreading allocations over the next few months.

Remember, when debt markets provide yields of 10%+ based almost entirely on fear, and markets take some stocks to levels below the cash they hold, you know that the market's being, perhaps, a little too cautious. It is when you invest in beaten-up-but-good stocks at such times that you can reap rewards. There is that, and there is the unknown-unknown - that we don't know what we don't know so cannot expect. Over the next few months, more fears will come, and others will subside. Our job is to invest in such a time and ride out the volatility.

Some Other Updates

We've mentioned about IL&FS transitioning to Indusind Bank so our exposure to the defaulting entity is gone. Another big thing:

The Supreme Court has said that Aadhar is no longer required by private parties. So, we will not need it any longer. We await regulatory approval to allow us to further remove all the aadhar documentation and linkage we had received, so that we remain compliant with this order and with SEBI's KYC norms.

We're looking forward to an even more interesting October and hope that stocks correct even more as we deploy more capital. And if you'd like to add more capital, we'll be happy to deploy that as well, as we have been doing. If you are concerned about anything, please let us know and we'll help address the situation. And as always, we are very transparent and forthright about all that we do, and if you feel we should be doing anything else, we're here to listen and serve.

Excited in all the volatility,

Deepak Shenoy