Building on as the rupee falls but economy remains strong

We tracked the Nifty from 2008 to 2018. That is, the Nifty stocks that were in 2008, assuming no changes since then. Of those only 17 stocks have a return that has beaten inflation in 10 years.

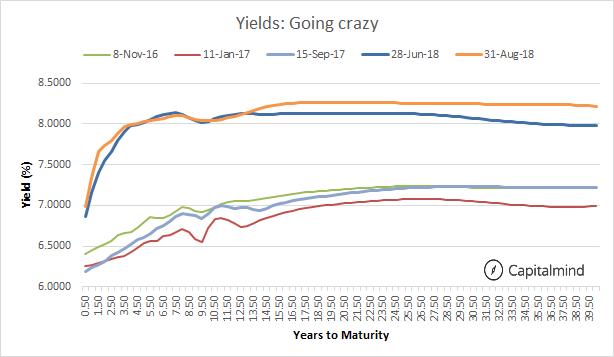

It's been an interesting month in August. For one we saw the rupee head to near 71, about the highest we have seen on the dollar-rupee rate. This is a problem only because we are a net importer through fuel. With that, there is a fear of rising interest rates, which is what is likely to hurt some of the market in the longer term, and indeed, rates are about the highest we've seen in three years. Here's a look at government securities - the "lowest" interest rates in the market - for various maturity periods on the X axis.

The orange line is the latest one, and the others are the same "yield curve" for different days in the past. In the last two years, rates have gone up substantially, but the recent rise is due to the dollar rising as well.

Remember, if the government's going to pay 8% for a 5 year bond, then a bank or company will need to pay even more because they aren't as safe. And this has an impact on the profitability of companies - margins contract somewhat. We are watchful, and even though markets are close to a high, this is an important risk.

In slightly better news, we've had the GDP Numbers come in at at a nice 8.2%. However, much of this has come from the manufacturing sector which grew at 13%, wildly out of sync with its own past growth. A little bit of the base effect has helped (there was a low last year) but even if you remove that, manufacturing growth will fall to 6.8%, and overall the GDP is still growing around 7%.

There are some factors we believe will continue to propel the economy forward. One is the return of exports with a weaker dollar and a strong US economy. Our portfolio has pharma exporters, IT service providers and auto component exporters that should benefit.

The second is the continuing flow of longer term money into stock markets. From the provident fund organisation which puts in over 1500 cr. per month, to the mutual fund SIP crowd that are adding about that much or more, we're seeing regular and strong inflows into the market, of about 150 cr. to 300 cr. per day. This has been increasing at a regular clip, and we see nearly all of this money go primarily into larger cap companies. Our strategy of primarily focussing on mid- and smaller- cap companies may not necessarily see any of this inflow for a while until our companies grow. So we'll rejig our market cap status to ensure we look more at solid companies with a 7000 cr.+ market cap in the new additions to the portfolio.

The last one is a spate of new NPAs that should further hurt most public sector banks. India went gung-ho on coal based power, about a decade or so ago. In the meantime, solar and wind provided a massive competitive layer as power sources, and we saw prices fall to below Rs. 5 a unit. At these prices, coal plants can't even begin to compete (unless they have captive or fixed coal sources, like NTPC does). The result? Power plants that are ready but cannot be started because they're unviable. Loans given to them should see a 75% haircut - so if a bank has given them a 1000 cr. they are likely to receive only Rs. 250 cr. in a sale.

Such steep losses result in a further clampdown on operations at PSU banks. Which means they won't grow at more than 7% a year in terms of lending.

Now India needs a credit growth of 12% at least (which comes from 7% real growth and 5% inflation). If 70% of your banking system (PSU banks) are only growing at 7% then the remaining 30% needs to come from private sector lenders. And that will mean private banks, NBFCs and Asset Reconstruction companies. So, we continue to own good financiers in the space, and will add more of them as clarity emerges.

In this context you may see the portfolio broaden in terms of number of stocks. That's normal, and we will reduce the number as we are aware of the outright winners in each of the spaces we are in. This is how portfolios will work in the longer term any how. We tracked the Nifty from 2008 to 2018. That is, the Nifty stocks that were in 2008, assuming no changes since then. Of those only 17 stocks have a return that has beaten inflation in 10 years. (33 of fifty stocks have been sub-inflation returns and 24 are negative absolute returns). But those 17 have given outsized returns, so much that even a buy-and-forget portfolio beats the Nifty in returns in 10 years!

We've done these tests many times, and found that concentrating on a smaller number of stocks has very little real benefit; and indeed we spread risk better initially and later, as the winners become obvious, we'll just increase allocations to them.

Another important thing this month is the acceleration to equity portfolio allocations. We've gone a little slow on equity so far, but most of the bad news we expected is now in. So it would make sense to now increase deployment into equity.

Some of the biggest investment opportunities have moved to startups. With Flipkart getting $20 billion as a valuation without showing a profit, or with PayTM seeing a Berkshire Hathaway invest in it, or with a Zomato command a $2 billion valuation in a recent round, we are seeing companies grow far too big before they go public. And these are the startups you use everyday, but can't directly benefit from. So we're getting into a player that's almost like a VC fund in them. Info Edge may run Naukri.com but it also has reasonably big stakes in Zomato, PolicyBazaar and a bunch of other startups. As they invest, we gain, in an indirect way, through our position.

We're seeing inorganic potential in some other portfolio companies too. Quess is a serial acquirer and getting stronger in facility management through acquisitions. Hero Motocorp has a 30% stake in Ather, which makes a pure electric bike that's releasing soon, and they've already put in Rs. 200 cr. in investment.

The scale of opportunity in India is immense but there's also some seriously high valuations out there, especially for some of the FMCG names. We'd pay a 55 P/E for a company growing at 50%, but when we pay 80 P/E for something growing at 15% we think that isn't sustainable. There was a time in the US - in 1972 - when there was a "Nifty Fifty". These were 50 stocks that had impossibly high P/E ratios, like Polaroid at an 82 P/E. The idea was that crazy levels of growth would makeup for the high P/E. In a few years, Polar oid lost 91% of its value, as markets corrected, and eventually went bankrupt. A similarly high expectancy for growth appears to exist in too many consumer stocks, and while history might not repeat itself, it might certainly rhyme.

In general, though, all this is our responsibility, and we'll keep digging deeper and act as we progress.

On the housekeeping front, we will soon provide you with more information in the progress portal including allowing you to set up automatic transfers every month if you should so desire. We have some losses booked in some accounts to offset the gains in the debt funds. We will continue to move from debt to equity and the losses booked should make up for the damage (we'll do another round of loss harvesting later in the financial year). Oh, and please do mail us at support@capitalmindwealth.com for any queries.

Best wishes for all the festivities this month, and we are looking forward to building more for you in the coming days!

Acceleratingly,

Deepak Shenoy