Muddling Through Markets

We are in this “muddle through” market, where nothing seems to be happening on the upside and there is not enough of a downside yet. Has this happened in the past? We looked at the data for one thing

We are in a no-go zone in the market for nearly all of one year, since the Ukraine war began. The Nifty returns are just 3% to 5% which is even lesser than a fixed deposit (which is around 7% now) There’s worry everywhere, and it’s not unfounded - in fact, we would probably feel a lot better if the market was actually down 25% or something, because at least that looks like a deep enough fall for being a good opportunity.

We are in this “muddle through” market, where nothing seems to be happening on the upside and there is not enough of a downside yet. Has this happened in the past? We looked at the data for one thing:

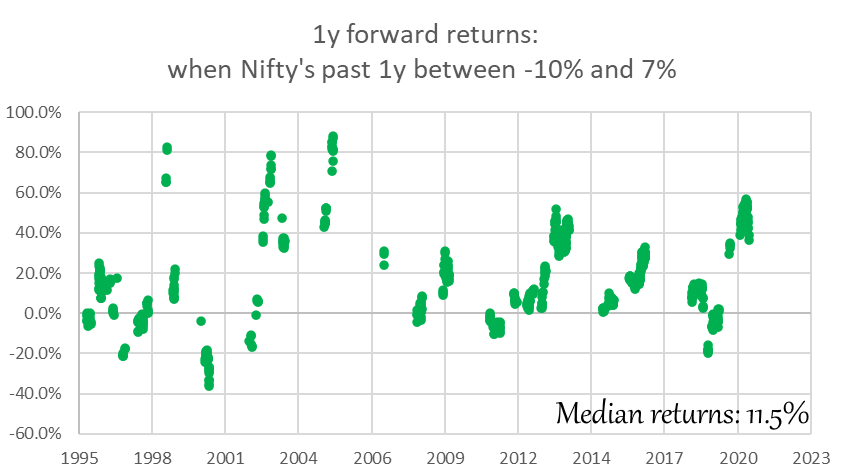

Tell us what happens when the Nifty return is “so-so” - i.e. when it’s less than 7% positive return in the last year, but hasn’t fallen more than 10%.

The muddle-through zone is actually quite a decent time to invest, it turns out. Or even, just stay invested. Subsequent returns seem to be way better than what fixed deposits seem to offer.

Right now, for example, fixed deposits offer a nice 7% to 8%, pre-tax. With roughly 1/3rd of such returns going to the taxman, the post-tax returns are between 4.5% and 5.5%.

To beat that, equities must return around 7% in a year. Has it done that in the past?

The question we are asking is: Have equities given more than 7%, on average, whenever it has looked like the past year has been “muddle through”?

For a single year of holding, past median 1 year returns have been 11.5%.

And in fact if we go further, to a 3 year return after a “muddle through” time, it’s even better:

In the three year time frame, we haven’t seen negative returns in the last two decades. And returns are actually very very good after that time.

What this tells us is:

- Staying invested in equity after a year of lousy returns (but not too lousy) is a good idea, looking purely at the past.

- In a three year horizon, there has been no instance of actually losing money when investing at such a time. This doesn’t tell you it won’t happen now, it’s just that it’s not happened recently.

When the Nifty’s last one year has been muddle-through

(less than 7% return, but hasn’t fallen more than 10%)

|

(data since 1996) |

1 year forward returns |

3 year forward returns |

|

We’ve not lost money (i.e. positive return) |

87% of instances |

87% of instances |

|

We’ve seen returns more than 7% p.a. |

59% of instances |

70% of instances |

Before we go around saying history will repeat itself, let’s tackle the other big question.

But isn’t it different this time?

We are fund managers, so of course we would say this, no? The past data is favourable to investing in equity. But so what, isn’t it different this time? Won’t the world go to hell in a hand basket in this year considering high interest rates, a probable recession, job losses and all that?

But there’s always a bad thing waiting to happen. Too many times it looked like Vitalstatistix was going to be right, for those of you who have read Asterix (and if you haven’t, it’s an awesome comic book set, where the character called Vitalstatistix was always worried that the sky would fall on his head)

There was Brexit, where the British vote to get out of the Eurozone. many eons before they actually did. It caused a flutter in markets, but no one now remembers. There was a volcano in Iceland that erupted and caused air traffic to shut down in Europe for a week. There was a worldwide outbreak of a hugely contagious Covid, which even locked the world down for months and in some cases, years. All of these things actually happened, and markets seem to have not cared. It’s the nature of the game to worry - and the sky never falls on Vitalstatistix’s head either.

So let’s do this: What’s going to take the market up, even in the near term? Here’s three triggers for markets to change:

One thing different now is that we have relatively high inflation in the west and thus, higher interest rates there, a phenomenon that’s only new in the last 15 years. Markets in the US saw rates above 9% for most of the 1980s, and after a recession in 1982, went on to make multi-year highs in subsequent years.

That’s because even in high interest, high inflation times, we will see good businesses make great profits. For some, their competition will just die. Think of it: when money was relatively cheap, you have to compete with someone else who can raise gobs of cash, hire away your best people for ludicrously high salaries, pay your customers to transition to them instead, and hurt margins for the whole industry because they are able to raise more money to pay for their losses. In a higher interest rate regime, money isn’t free anymore, so these pay-to-play companies will die, and those with an actual business model will take over their market share.

Even businesses that take on large amounts of debt might win, simply because they can now get into areas where their competition cannot, simply because the competition can’t raise money, equity or debt, to service new markets.

High rates are not bad, rising rates are. When there is a stability in rates, even if it’s high, markets will find their winners. And then, even if inflation has been high in the west, the base-effect of higher crude prices in the rest of the year will ensure that relatively speaking, inflation numbers will see some correction in 2023.

Another trigger comes from liquidity. Foreign investors have continued to be net sellers for the last 16 months, taking out over 190,000 cr. (usually they invest about half that much per year). If there’s less jitters about a further rise in rates, we will see money stop flow out. That itself is enough to allow the large domestic investments (through mutual funds) to let stock markets correct somewhat.

The last trigger we see is from actual earnings. Already, the Nifty 50 companies have grown their net profits by 19% in the December quarter. This is one of the best quarters that we have seen in the last decade, adjusting for outliers in the one-time hit and recovery due to Covid. For a Nifty that went up only 3% in the last year, this is a good sign.

If earnings continue to grow at this pace in Q4 as well, then at Nifty’s current value we pay less for Rs. 1 of earnings than earlier. Put another way, we get more net profit for every rupee we have invested in the market.

To summarize the three triggers:

-

Interest rates will stabilise. Winners will emerge from a high-but-stable-rate regime.

-

Foreign institutions will tire of their selling, allowing markets some space.

-

Earnings of Indian companies are rising and that makes valuations better.

None of this happens tomorrow. No one cares about a slow change, but it’s the only kind of change that matters in the long run. Our job is to look towards the next decade for what will turn out to be great opportunities. But we’d like to address the elephant in the room: Why aren’t markets giving even as much returns in the last one year as fixed deposits?

When they start to look like that, they often give way better returns in subsequent years. Markets are often the best to participate in when everyone’s bearish.

Addressing our inner Vitalstatistix,

Deepak