Sleeping and Staying Awake

Investing is simply a way to make money when you sleep. But for that, you really need to able to sleep.

Sleeping and Staying Awake

I was going through some really old papers, all the way back to 1977, in an effort to finally clear out a box of papers that we had kept since my father passed away more than 20 years ago. It took me a few hours, and through all the emotions, I read through how my Dad had invested and saved his money. Our correspondence with the bank he worked for after his passing on, how it all panned out and so on.

He had a loan for a house, topped up with another loan because the builder refused to finish the property unless we paid more. A set of life insurance policies against this loan as a second security.

And, then another loan against shares at nearly 19% interest. He would take his savings and invest them in shares, and to discourage himself from selling any, he’d put that as collateral against an account, from which he would draw money for urgent expenditure.

After he passed away, nearly all the “settlement” that was received - an untaken leave encashment, gratuity and provident fund, along with the insurance policies, went entirely to pay for the housing loan and loan against shares. It was crazy also because what he made as a salary was so little, that very little was left to save, and he’d put all of that into shares of companies when he could.

I was working, and my mom had a house, so it wasn’t too bad, but now I realize the implications of having worked 35 years, and having very little actual cash left at the end.

But that’s not the story. The story is that once we paid up the loans, we may have had very little cash left, but we had the shares, now freed from the loan collateral. Mom still has these shares today.

These shares went on to make my mom more than 50x in the next twenty years. Now, she gets as much dividends per year as the entire portfolio was valued at in 1997. And all this from about 8 companies.

We had a lot more than 8 companies. This was a time when people owned physical shares, so I have the share certificates of many companies - 30 to 40 companies in all - which don’t exist any more. Some that have gone private. Some that just died. In terms of survivors only 20-25% of the companies we owned even survived. Among them too, there were those that were gobbled up or broken up - Brooke Bond became Hindustan Unilever, L&T split into L&T and Ultratech, and so on.

Even with nearly 40 companies, only 8 survived. And just those 8 gave us superlative returns over 20 years. If you valued the entire 40 companies in 1997, the return even with a low survival rate translates to 17.7% a year in 24 years - a 50x return.

The one difference here: there was no selling, for most of the time. Largely because for the first few years we had no idea how to sell. After that, there was no inclination to do so either. And no attempt to “rejig” the portfolio, which went from 50% in one stock, to about 35% in another while the big one reduced to half and so on.

Is No-Selling A Valid Concept?

We often look at our portfolios and wonder - should we even keep this stock? It’s so boring, it’s not moving at all, etc. We do this often, even with our mutual funds. But the simplistic point of just diversifying enough and investing regularly regardless of how bad certain stocks are performing, can be a rewarding strategy.

Like in our case - more than 40 companies, but just 8 survived, and the overall return was 17% a year.

Or take the Nifty in 2010. It’s been 11 years since, and if you invested Rs. 100,000 in each of the Nifty stocks then, and completely forgot about the whole thing, you’d be sitting with a portfolio worth Rs. 1.2 cr. today, not including dividends. Even though:

|

Between 2010 and 2021 |

||

|

Fell more than 90% |

7 stocks |

The Adag pack (Reliance Capital, Inflra, Communications, Power), JP Associates, Suzlon and Unitech |

|

Between -15% and -90% |

12 stocks |

The Public sector folks (SAIL, PNB, BHEL, ONGC etc) and Idea, Tata Power, DLF, Jindal Steel |

|

Less than double |

9 stocks |

Stawards, you’d think: Tata Steel, L&T, Abb, Tata Motors, SBI and so on. |

|

That’s 28 stocks of the Nifty so far |

||

|

Less than Nifty’s 10.7% per year return (The Nifty itself returns 10.7% a year since 2010) |

9 stocks |

|

|

Between 11% and 20% a year |

9 stocks |

|

|

More than 20% a year |

4 stocks |

|

As you can see, more than half of the Nifty stocks then, in a buy-and-forget mode, have given substandard returns. And yet, the portfolio as a whole has done very decently - nearly as much return as the Nifty. (The Nifty returned 10.7% versus the buy-and-forget’s 9.3%)

The best stocks give you nearly all of the returns. You may not know the best stocks are when you start, but as you move on, it’ll get evident.

The Nifty replaces stocks every 6 months. And yet, all it did was manage to give just 1% more returns than if it hadn’t bothered. This has been true pretty much whenever we have done this analysis. Sometimes, like between 2006 and 2016, the buy-and-forget portfolio has actually beaten the Nifty! (Read our post)

Most of this is tax free, but even at a 10% tax, such a return would have beaten most fixed income products like deposits (where you pay tax every year).

What’s your point, Deepak?

That the opportunity in the markets is still massive, even if what you think you’re saving seems minuscule. My father’s salary was less than Rs. 15,000 a month, and yet, the little savings that he had grew over the years to a point where my mother has enough income just on dividends, to live reasonably well.

The lesson is to stick with the winners, and don’t focus too hard on the losers. You could get rid of them, but they don’t change anything - it’s the sticking with the winners that makes the difference.

Perhaps the Bitcoin was a bigger opportunity, or any combination of Adani stocks. But there will always be those in hindsight; and the volatility in either of them will make you want to “book profit” or do things to work with the short term. While such choices can embellish portfolio returns, you have to monitor regularly anyhow. I mean, who ever thought in 2011 that an Anil Ambani would be tottering on the brink of bankruptcy?

Investing is simply a way to make money when you sleep. But for that, you really need to able to sleep.

Speaking of Sleep

I had a battle with Covid-19 myself last month, and luckily, I’ve lived to tell the tale, and even more luckily there wasn’t that much of a tale to tell. But the one thing that I learnt during the two week quarantine was: how nice it is to just sleep. Having been a workaholic for over two decades, I’ve just rediscovered what it means to get enough rest - and now I’m sold.

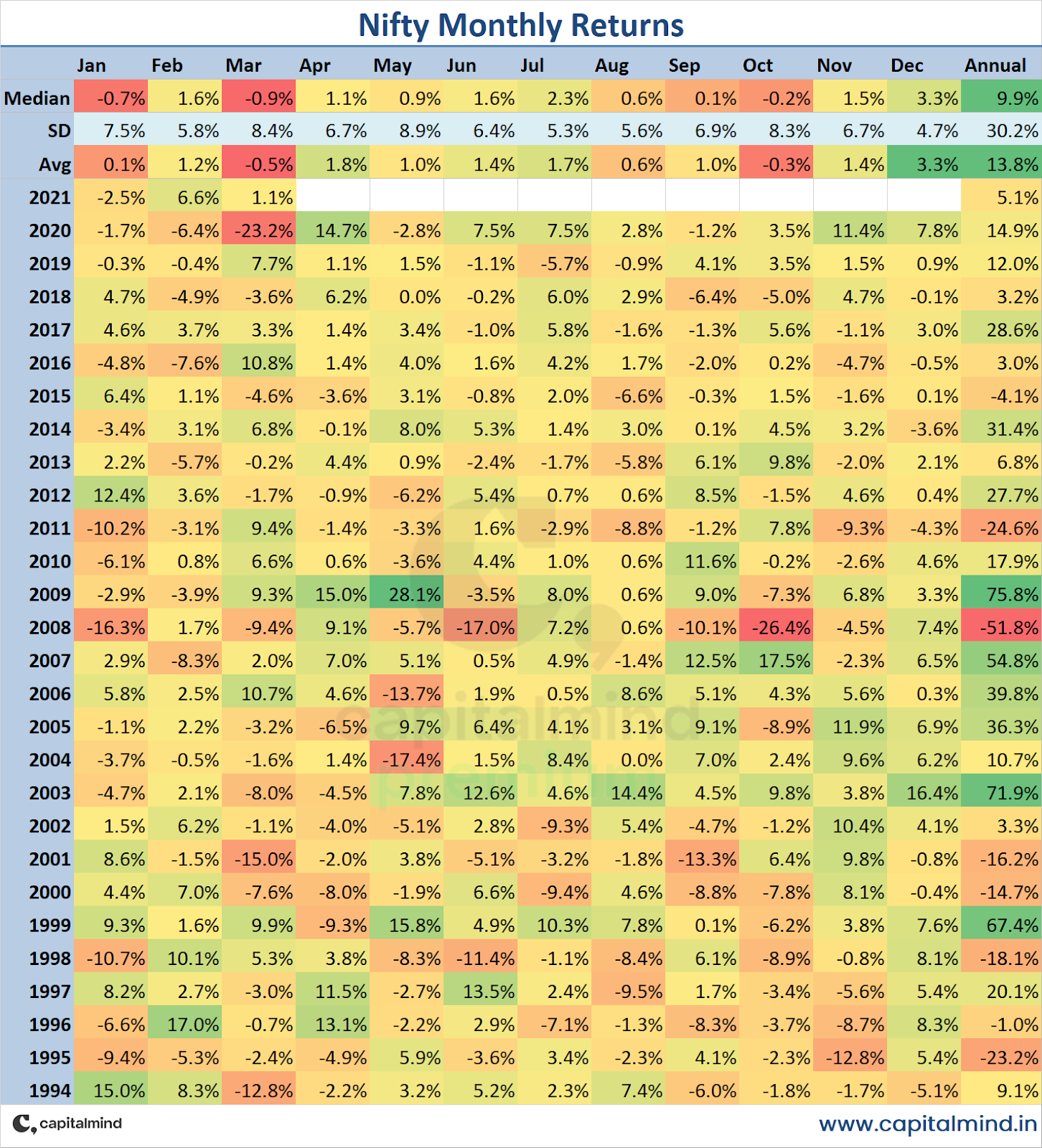

Markets too look better if you can sleep. The last year has been remarkable - and no one could have slept through it, but if they did, they’d see the Nifty up 70% between March 2020 and March 2021. Even the calendar year 2020, which you would think was terrible, was still a 15% positive return!

As fund managers, we like to say that activity is important - after all, we constantly analyze markets and macro and all this for opportunities. But that’s also because we’re looking for winners - if you have to stick with the winners, you need to have the winners in the first place.

The philosophy of just sticking with the indexes - the Index portfolio that we have, consists of the top 100 India stocks and the Nasdaq 100 - has been quite reasonably rewarding. Between March 2020 and March 2021, this strategy returned over 55%. Momentum, where there’s enough and more activity, managed to sidestep much of the downside and went up over 70%. The Long Term multicap strategy was about 55% in the same time. In terms of relative returns, Momentum’s done really well, but even if you simply allocated across the three portfolios - as many of you have done - you are likely to have done very reasonably.

What happens with Covid?

Things will change. Lockdowns are upon us again, and to be honest, the reality is this: Most of you who read this will not be affected financially by lockdowns. We’re the top 1% in economic terms, in this country, and have enough safety nets to survive. Our country, though, will need a lot more help from us because the other 99% will be disproportionately impacted.

Life will have to find a way. But it may need us to participate in that recovery. The kids of the lower economic strata that have fallen behind a year now because of flaky internet connections and lack of laptop/power. The small restaurants and shops that might have closed forever. The aged who had been surviving on some odd jobs earlier.

When an old person struggles to cross the street, we stop to help - but only because we can see them. In lockdowns, we can’t. So we might just have to look harder. In this context, we might need to be more awake.

At Capitalmind, we’ll work hard to keep the portfolios powered up. And look carefully at the disruptions for more interesting opportunities. As this surge in cases seems to take over, it’s becoming obvious that the lifestyle we have built over the years is surprisingly fragile - all it takes is an RNA with a little spike protein to change everything. Everything in our portfolios will look different five years from now, and the winners will be the survivors. Our job is to ensure you can sleep better, and it’s taken a Covid for me to personally realize how valuable that really is.

Like all things, good and bad, must come to an end, so will this pandemic. And so must this letter.

We wish you a safe journey ahead, with wishes for Ugadi, Vishu, Easter and things that remind us that the winter has an end.

Summer-fully,

Deepak