Market Anand Sheela

There are no heroes. It doesn’t matter what you know, because, as an outsider, you just don’t know enough.

It was a chilling documentary called Wild, Wild Country. The story about “Osho” Rajneesh and how his ashram started in Pune, moved to Oregon, and built an entire town of sorts there with thousands of disciples, who fought a long, hard battle with nearby towns, the state and the US Supreme Court. Some disciples even took to crime, attempting to poison a nearby town by putting salmonella bacteria in their water supply. The criminals were led by Ma Anand Sheela, who was Rajneesh’s personal secretary and eventually pled guilty.

It’s almost unthinkable that a sect whose core ideals are meditation and free love, should resort to such terrible deeds. What you’re left with is just this: There are no heroes, no one you should believe is beyond reproach, no matter what. Such power corrupts.

The market has just been punched in the face with this. You could not imagine, a few years ago, that very large companies or stocks like Zee, Indiabulls Housing, or even DHFL, could be pummelled down in this way. You couldn’t imagine that an Ambani, even the younger one, would see most of his companies totter into bankruptcy. You couldn’t see how it was possible that promoters that were closely linked to even the current political powers could be investigated for fraud.

And it’s happening. There are no heroes. It doesn’t matter what you know, because, as an outsider, you just don’t know enough. Even people within the company don’t know quite as much; there are Jet Airways employees who still believe the airline can be revived. (The airline hasn’t operated for months. Nearly all top execs have quit, the auditors have resigned saying they don’t know who to even send their resignation because no one exists, and all the aircraft and slots have been taken over by other airlines). Interestingly, the stock still trades, at a price of Rs. 25, and has consistently hit upper circuits since October 25. Such hope.

With the lack of heroes, and information you can really trust, what can you do? In the market, there’s a free pass for this: Diversify. For every person that bet his fortune on one or two stocks and made it, there is a graveyard of those that didn’t. You’ll see them everywhere, even today, looking to bet a large sum on a stock that they have seen beaten up. The problem? If you don’t bet, you can’t win. But if you lose all your chips, you can’t bet.

The problem is behavioural. We “like” that one big winner because it’s fodder for the right way to glory. That Buffett, the legend, bet all that much on Amex and made it big. Never mind that he has a gazillion positions now, or for most of the last 25 years. Even in India, some of the mutual funds that beat the market had more than 80 stocks. Even the indexes have a very large number of stocks - 50 for the Nifty, 100 for the Nasdaq and so on. This is why a fall of 80% on the Yes Bank share didn’t affect the Nifty very much - the position was only one in 50, and even then, the weightage was tiny.

Because we can’t trust the “heroes” and we can’t know everything, we should diversify. This is also why owning a second house isn’t wise until you have a LOT of money, because you’re nearly 100% of networth in one investment. (The first one, anyhow, is hardly an investment. It’s an expense. Listen to our podcast)

When I was 18, I knew everything. When I was 30, I wasn’t so sure. When I’m 45 - I turn that much this month - I know that I know very little, and I have to stay more questioning of everything. This is why older people are cynical. They’ve seen that trust abused.

Oh, if you’re old enough, you know that Tina Turner song: We don’t need another hero, we don’t need to know the way home.

On that note. Do not believe anything the news channels are throwing out as “source based” news. Or what seems authentic on whatsapp. We live in a world where news is created because, as the saying goes, why let truth get in the way of a good story?

While The Market Was Sleeping

Wish you all a very Happy Diwali! It’s been a very decent month for the markets, with a 4% rally in the broad indexes and a small revival in the midcaps. The first set of results indicate that the tax cut by the government will eventually help, but for now companies have to take a tax hit because of a Deferred Tax Assets adjustment that effectively means whatever they expected to save them from taxes is not worth as much now, so it goes in as a loss. This is a one-timer, so it won’t come back into accounts in future quarters. It’s probably better to ignore this quarter, unless companies show super-normal profits.

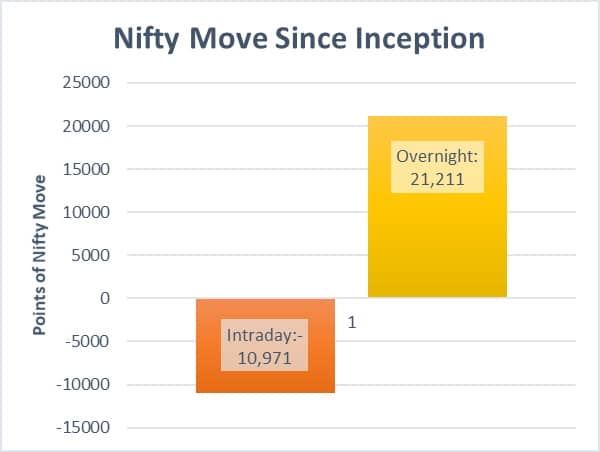

The most interesting thing is that the market makes money when you sleep. No, really. If you bought at the open, and sold at the close of every trading day, the NSE Nifty would have given you a big fat negative return. All the intraday moves added up since inception have been a negative 10,000 points on the Nifty. So if the Nifty started at 1,000 and is now nearly 12,000, where did the gains come from?

Answer: The move when the market is closed - that is, overnight. The market has returned a cumulative 21,000 points when you were sleeping, or when the market is not trading.

Read more about it:

What this means is simple: that activity that happens in the trading day isn’t exactly useful, for the most part, or even the ability to “buy at the best point” of any day. The money is made when the market doesn’t trade.

Housekeeping and SEBI changes

We had a decent month on the equity side of the portfolios, with about 6.5% as a monthly return on the Multicap, and above 4% on the Index and Momentum strategies. This is against a 3.7% Nifty and 4.4% Next 50 performance (with dividends reinvested).

In a SEBI meeting a couple days later, we might see a change in PMS regulations. This could mean an increase for new customers to Rs. 50 lakh (current PMS customers will be allowed to carry on their balances as long as they like, if the draft regulations are taken).

If this should happen, you can still continue your investment with us, as current customers will be allowed to. If you would like to add more money, that might require the Rs. 50 lakh minimum (total investment), so we offer you all a simple mechanism: you can place upto Rs. 25 lakh in a debt fund with us, and our fees for that amount will be Rs. 1 only. This ensures that you can continue to fund your future SIPs but take no more risk than you need to and at the same time, you don’t need to pay extra fees. Please contact Akanksha for details regarding this, and we will send another mail after PMS regulations are finalized on November 7.

We’ll leave it there for this time. It always ends up longer than I thought when I started, and I hope you’re still here. Best wishes!

Cheers,

Deepak