The markets that need a spark

Loyalty is for friendships and relationships, but companies that you invest in, that’s a business. You don’t fall in love with your inventory, no matter how much money they’ve made you.

Firstly, thanks for visiting the town hall in January! We really appreciate your feedback and presence, and look forward to a better 2023.

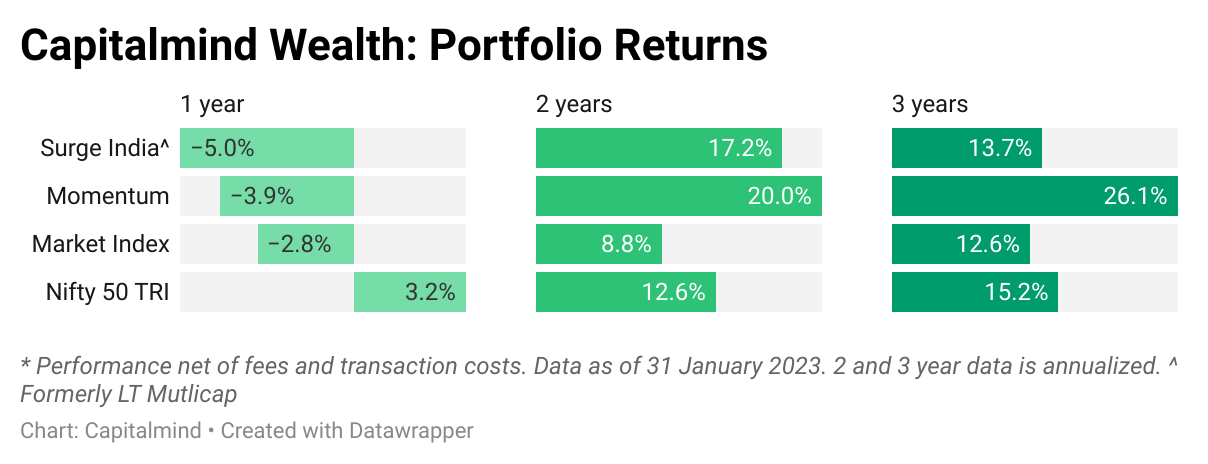

Our performance for the last three years:

We’ve had a rough season on portfolio performance in the last year. In the longer term, while Momentum has had an excellent run, Surge India and the Market Index have had some setbacks. We have realigned Surge India as a portfolio recently, and Market Index is seeing some small reprieve with the Nasdaq coming back up, and we hope to see some good numbers going forward.

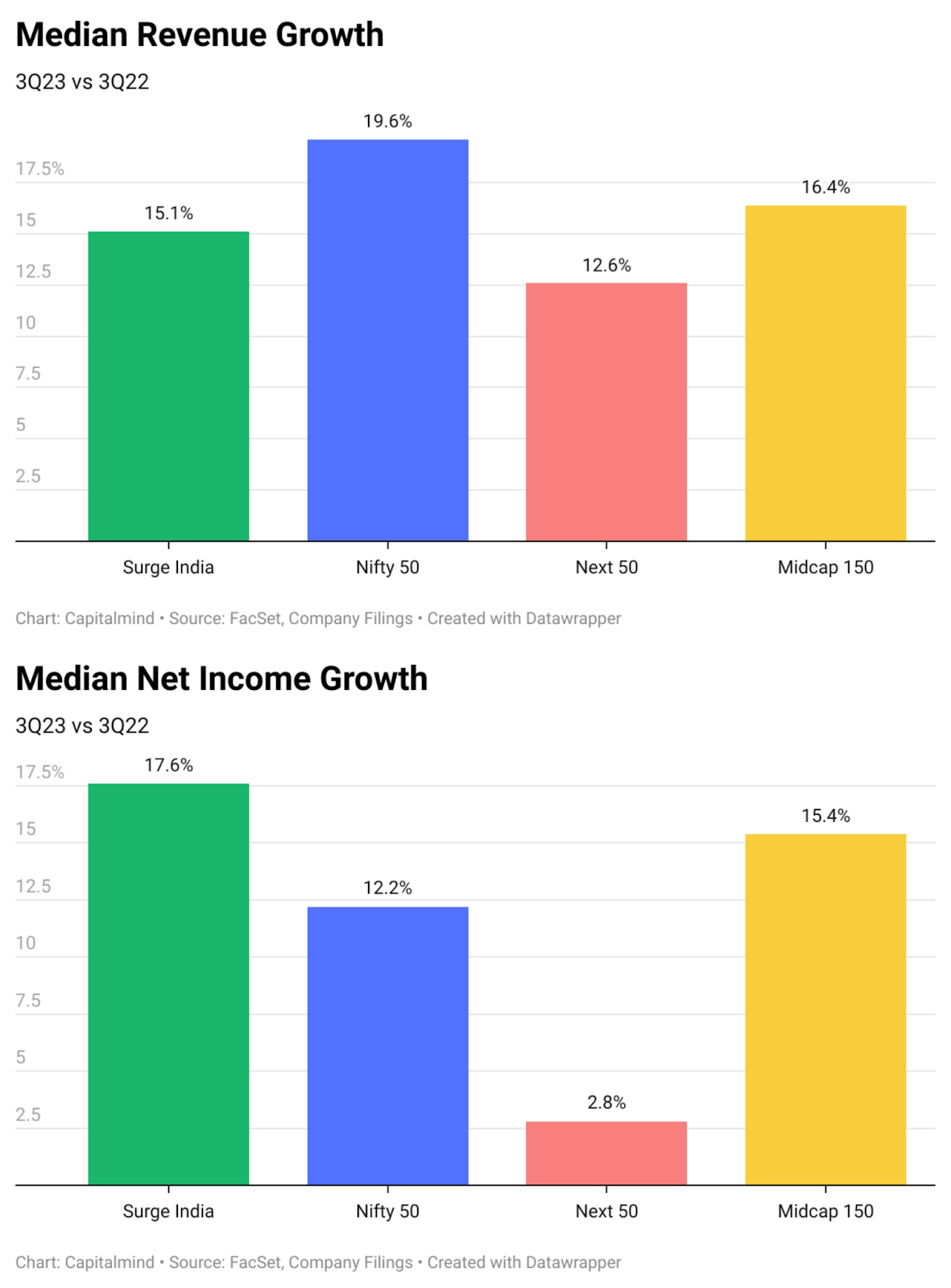

On the earnings front, Surge India has started reasonably (though some results are yet to come). Revenues, measured by the median, are up 15% year on year in the quarter, which is comparable to the Nifty’s 19.6%. The more impressive number is the net profit after tax, which is up 17.6% compared to the Nifty’s 12.2% so far (median stock performance). Now this is still a little early to say, but it means two things:

-

Nifty’s growth is impressive - a nearly 20% revenue growth and a 12% profit growth is good. It does mean, though, that margins are getting hit (as profit growth is slower than revenue growth)

-

Surge India seems to be doing better on margins - with a much higher margin profile than the Nifty and than revenue growth too.

This is partly due to some extreme outliers on both ends. We had a phenomenal quarter in LIC’s numbers. There, it’s almost like they realize every quarter that there’s some profit that they should be giving to shareholders, and find the numbers to deliver. The stock price has not yet realized it, but this appears to be a company that has a profit pool of between 25,000 cr. and 30,000 cr. per year, valued at 400,000 cr. It’s increasing market share and the recent budget changes are unlikely to hurt it all that much as they serve a relatively lower income population. Yet, we believe that the market will take a year or more to realize this potential - simply because that’s how markets are. They will refuse to believe until they have no choice.

On the flip side we have had some stinkers from the likes of Garware Fibres and Balkrishna Industries, mostly on the back of a slowing Europe and a recession-headed North America. We’ve seen these stocks give us some amazing returns in the last few years, but if the situation looks like they’ll suffer a major valuation correction for an extended period of time, we’ll make our calls to reduce or sell.

That’s one thing we strongly believe at Capitalmind: Stocks don’t love you back. I could extol the virtues of either of these stocks. Garware did an incredible thing - gave up 10% of the shares of the company owned by an employee welfare trust so that all shareholders would see a 11% jump in earnings per share for the exact same earnings. Very few people do this (Escorts is another that’s doing it right now). The stock too, has served us well - it’s gone from a boring 900 to 3,000 in less than three years. But this doesn’t mean we stick with it forever.

There are headwinds for the company. Valuations are richer than they used to be, at 35 times earnings. The situation in Europe isn’t going to recover soon, and when it does it will be slow. The price of the stock too has shown some damage too, falling around 20% from its recent peak. There are better players that fit the Surge India philosophy.

Loyalty is for friendships and relationships, but companies that you invest in, that’s a business. You don’t fall in love with your inventory, no matter how much money they’ve made you. And the important part of selling a stock when you aren’t attached to it: you can buy it back just as impassionately, even at a higher price, when the stock shows promise again. We’ve had great exits recently - from BSE and Indian Hotels - and if the businesses start to look good again, we’ll be back.

Of Budgets, Infrastructure and the Macro

The budget has been good in the sense that there wasn’t something insanely bad in there. We have sent a note earlier on the stuff that actually matters to you (read here for more) but in general, events like the budget are no longer as important as they used to be. The government often changes its financial stance at other times in the year, and in reality, government spending is less a function of stock market related earnings compared to the past.

But one thing does stand out: the government is serious about infrastructure upgrades, and domestic manufacturing to substitute imports. The Vande Bharat train project for example, isn’t something spectacular if you’ve travelled in trains abroad. It’s a nice train, and very nice if you compare it to the zamaana-old trains we used to travel in, but it’s hardly earth shattering for its interiors. The bigger deal is that it’s manufactured nearly entirely in India, and that reduces our need to import the locomotive or engine. Import substitution is happening and at a rapid scale - another 400 trains will come, in the next three years, to augment the ten that currently run.

India is one of the only countries that CAN replace imports meaningfully. We have a large domestic population worth serving, and we’re slowly getting richer too.The number of taxpayers showing incomes of Rs. 10 lakh or more (top bracket) have gone up from 30 lakh people in 2016 to 81 lakh in 2021. Serving this population has largely been from imports - big brand name garments or shoes, electronics, accessories, toys etc. But as you get more homegrown startups to address them (even if foreign capital funded) the local economy develops a lot more. As this happens, our markets which have seen so much domestic capital enter as well into public markets, should see strong earnings and thus, returns in the longer term.

None of this will happen in a year. If you build the roads, the railways and the infrastructure, they will come but they’ll still take time. The winners of tomorrow may just not be the winners of yesterday, especially when there’s a major change in the landscape. It’s dangerous to be “married” to a stock precisely because of this: markets change, and so must we.

The story you cannot avoid

You can’t have a stock market newsletter without mentioning Adani nowadays. We said in the town hall that nearly all of the 7% growth in market cap of all Indian stocks last year came from the Adani group. We were uncomfortable with most of the stocks - up and down in circuits isn’t good for the momentum portfolio, and Surge India balked at the debt levels. Now, this “avoiding” the group almost seems like a good thing, in just a month.

The market index is exposed as the Nifty and Next 50 have some holdings in these stocks, but a passive portfolio shouldn’t be second-guessed. Our policy is not to love or hate any stock, but to work with the merits. In this case, the events that have transpired in the stock market have now started to impact the business itself, with partners stalling joint ventures and debt costs for refinancing spiralling up. Markets are “reflexive”, in that fundamentals impact stock prices and then, stock prices impact fundamentals. The spiral has an upward bounty when things go right, but a dangerous feedback look when they don’t. Regardless, this has very little impact on the banking system, the stock market or the overall economy, so it hasn’t changed our outlook on a resurgent India.

Much as the investing goes on, this letter has to come to an end. I’ll end with a “sher” (urdu couplet) by Ahmad Faraz, that I heard in a lovely video about “Train 18” by Sudhanshu Mani:

shikva-e-zulmat-e-shab se to kahin behtar tha

apne hisse ki koi shama jalaate jaate

(Shikva = complain, zulmat-e-shab = the tyranny of darkness, shama = fire)

Better than to complain about the pain of darkness,

You could just choose to light your portion of fire before you left

To finding some of that spark,

Deepak