The Market Has a High Maaz-Laiki Ratio

If we can’t explain why it went up, we will not be able to explain why it fell either.

A conversation between friends, about Barack Obama’s humility, ended up with a comment that I just had to explore:

“In college, we would say he has a low Maaz-Laiki ratio”

The non-marathiness of a few of us meant we had to know more. It turns out that Maaz is arrogance or “ahankaar” - a kind of hubris about how someone thinks too much of himself. Laiki in this context is just the real underlying worth of something.

Someone with a high maaz-laiki ratio is a person who has extreme hubris but is actually worth a lot less.

This stock market is like that. There’s a lot of expectations. But the reality is still quite sublime. A few things that make the “laiki” part of the phrase:

The GDP was DOWN 7.5%, the second down quarter in a row. The full year is expected to still be down 7%+. If this is true, this will be the worst one year in the history of recorded Indian GDP - the worst, before this, was -5.2% in 1979-80.

While Q1 had a lot of government expenditure, Q2 has seen a 22% fall in govt spending too. Private consumption is down 11% in Q2. This is pretty much the worst it has ever been.

Banks have seen a standstill in bad loans because of a Supreme Court stay that requires no further bad loans classified until it decides on a court case about the interest moratorium. But still, credit growth is less than 6%, even after the lowest interest rates in two decades. Worse, industrial credit is still contracting, and is roughly equal to what corporates had borrowed in Jan 2016 - nearly five years of stagnancy.

We know about restaurants. About malls. About movie theatres and even relatively low numbers in air traffic. About entertainment of the non-online sort. All this is in really bad shape.

There are pockets of excellence, of course. Pharmaceutical companies, online entertainment and information providers, chemical suppliers to those that want to derisk from China, large players in industries where competition has been wiped out due to Covid - all these have shown very decent numbers.

But the stock markets remain strong - and around the world, many are at all time highs. This is perplexing, but explained partly by the strongest bout of liquidity we have ever seen. The US, Europe, Japan and the UK have pumped in more money in their bond markets than ever before, around $5 trillion. That money no longer earns anything in the fixed income bond markets (where interest rates are zero) so it flows into stocks. Stocks go up because they have to compete with a zero interest rate. So if you have a pulse, you’re a worthy investment. Pulse is optional, sometimes - a defunct airline and an about-to-be-bankrupt bank traded at high values very recently in the market.

We have decided at Capitalmind that we’ll be cautious, but in the process, ride the rally. When markets go up it’s sometimes impossible to explain why they do. In 1999, when markets went up 15% in May, people were worried that the market was hot. But it continued with a 25% increase in the next three months, and then another 30% in the next few months before it crashed. The levels of May 1999 would eventually be broken on the way down, but in 2001. What we’re saying is: markets can be so unreasonable on the upside that it could go up much more and crash.

The markets will hurt when they cut liquidity. And the RBI policy recently said just one thing: we want growth at any cost even if there is inflation. This means interest rates will remain low for a year or so. This means the authorities want to ensure that the best (or only) returns are in risky stocks. This is a signal for us to not fight too hard about the valuations but to still be wary enough to protect profits if things start to change. If we can’t explain why it went up, we will not be able to explain why it fell either.

There’s a lot of “headweight” in the market’s valuations, and we must recognize that markets can run very long on high Maaz-Laiki ratios.

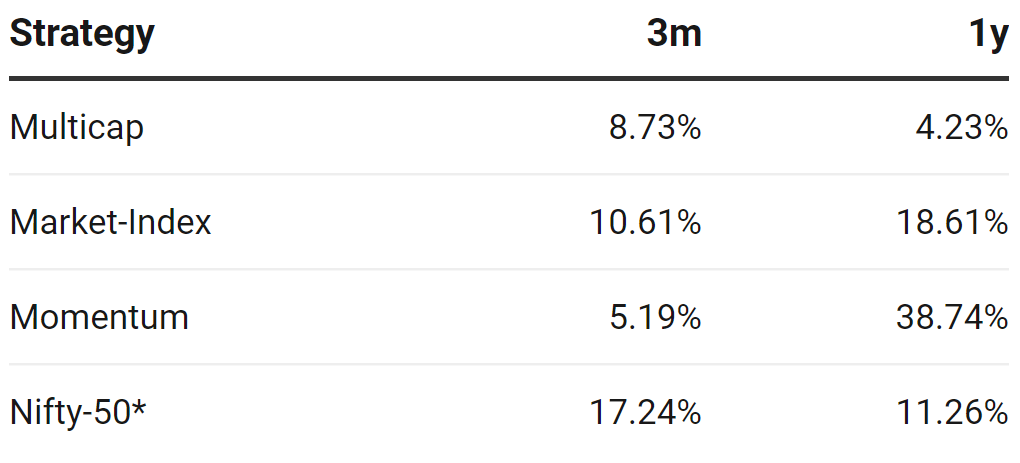

At Capitalmind Wealth, we have multiple strategies - the equity ones are Momentum, Market Index and Multicap. If you would like to rebalance between them, please let us know. Our performance in the multicap strategy has been lousy in the first two years,and that’s haunting us since. As much as we are trying to fix that, we believe it is in your best interest to diversify into the others.

* Includes dividends

The last three months have been rough for all strategies, but the two “algorithmic” strategies have given relatively better returns in a longer period of time. Market-Index continues to do well with the Nasdaq 100 having given a really good return in the last one year.

Fixed income returns will now likely reduce, at least for liquid funds, so we will increase the “duration” of the funds we invest in.

The month of December has the first four days already getting Rs. 16,000 cr. from the FPIs. The RBI policy remains quite dovish, with interest rates likely to remain low for a while. Markets are slaves to such liquidity, and unless money goes out, we’re going to just have to raise our eyebrows all the time. Experience tells us that such times do not last, that there will be a deep enough correction at some point. But experience did not teach us much about Covid, a very rare event even if predicted by many people including Bill Gates. Experience hasn’t worked very well for fears about inflation due to extreme printing of money. Experience may tell you a lot of things about the past, but the only thing it tells you about the future is that there is more to learn. And that perhaps that the more things change, the more they are the same.

Flush with the liquidity,

Deepak