Craziness In Debt Markets And More

We’re having a liquidity crisis for NBFCs whose cost of capital has risen, and in India banks are quite lazy and restricted, so much of the lending still originates at nonbanks.

As another month passes by we bring you Capitalmind’s view of the markets and where we stand.

This has been a rough start to 2019 for the broad markets, with some stocks correcting substantially from the peak reached in middle of last year. At Capitalmind Wealth, we’re confident that this will reverse in the coming months – especially after elections. There are multiple reasons for our thought process, but more importantly, here is the broad picture of what’s happening.

There’s a liquidity challenge for nonbanking finance companies. This started with the IL&FS problem in September, when they defaulted on some debt. And that led to mutual funds that invested in debt hurting, and when their investors saw prices falling, they exited. Exits from a mutual fund mean that the funds become sellers, not buyers – and therefore, the companies that borrowed through the mutual fund route (selling their debt paper to mutual funds) suffered a setback as they weren’t able to borrow more. Specifically, the NBFC crowd was hurt, because their borrowing costs went up.

The impact hasn’t still gone away. That crunch, which hurt borrowers from mutual funds, had a victim that wasn’t immediately evident. The promoters of Zee and Dish TV, the Subhash Chandra family. Zee’s a neardebtfree entity and has excellent cash flows. But the promoters had borrowed a truckload of money through the mutual fund route, issuing bonds and placing their Zee stock as collateral. What did they do with the money? Invested into a bunch of infrastructure projects, from roads to power to solar.

These projects had no incoming money, and lots of them were in trouble. If you don’t have cash flows, and you have to pay back those mutual funds when they mature. But when mutual funds are in “sell” mode, they’re not going to give you money. And this wasn’t a small amount of money – just the bonds issued were over Rs. 10,000 cr. In size, and on the lending side were banks, mutual funds and institutions.

From October to December, the Zee promoters somehow managed to keep things going, but after a long wait, the lenders to these bonds decided enough was enough. They decided to sell the collateral – the Zee shares – in the market to recover their money. You could do this easily if you tried it with a 10 crore sale. But when you try to dump shares in the market worth a few 100 crores, the share price tanks – and the Zee share price fell from 435 to 300 on one fateful Friday, a drop of 30%.

Over the weekend, the lenders gathered their wits and realized that selling abruptly would destroy the value of their collateral, so they hammered an agreement with the Chandras that he would sell his stake to a strategic buyer, and use that money to repay them; and they wouldn’t sell any more shares in the market.

This leaves us with a tricky decision. We owned a mutual fund in the Wealth accounts – the Baroda Pioneer Treasury Advantage Fund. This fund had a large exposure to the Zee promoter company debt. Sure, there was an agreement, and the Zee shares had started to recover (they went back to Rs. 360 in a day) – but in our experience, such agreements are based on good faith, and sometimes, when there’s 8,000 crores involved, good faith can break very fast. We decided to exit the fund in question, even though there was no visible price damage on the fund itself.

In addition, another debt scheme, the Kotak Low Duration Fund, was sold. This wasn’t because of a Zee exposure, but we found that all such schemes have a larger concentration of corporate debt which would inevitably suffer in the aftermath of the Zee crisis.

You would have seen these sales in your accounts recently – the money has now been reinvested back into debt, but into larger liquid funds.

And then, there was DHFL

A “Cobrapost” expose gave us a view into how murky the world of finance really is. DHFL has to respond to allegations that it financed its own promoters, but mostly the market has known that. We are looking carefully at the debt markets for signs of contagion, but our analysis indicates that the company will survive (but not grow) as it progresses, and it’s unlikely to spread to other players because they seem to be mostly funded through retail deposits and bonds, and their home lending portfolio is still relatively good.

The debt markets, at this point, are not in panic mode. NBFCs continue to be able to raise money, and the good ones are not even paying very high rates (a borrowing cost of 9% in October is now about 8.1% for the same entity, which is a positive sign)

The Slowdown in Auto, and How We Think It’ll Play Out

There’s been a big correction in Auto stocks. We believe part of it is due to the NBFC crisis – as rates went up for nonbank lenders, the financing costs increased and that has resulted in a slowdown in sales growth (most vehicle financing is done by NBFCs).

Part of it was regulatory. For cars and twowheelers, the Supreme Court had ordered that insurance needed to be bought for three years (cars) or five years (two wheelers) rather than one. That’s effectively caused a price increase, and the overhang lasts a while. We expect the impact to last till February, and believe the market will recover after.

For commercial vehicles (where we have ancilliary investments) the increase in axle loads has seen a drag in the demand, which we again believe will reverse after March. The impact of higher axle loads now means that people can have about 25% to 30% more loads on the same truck, so they don’t need new trucks to marginally increase business. However, this effect doesn’t last too long, and eventually, as growth requires it, new trucks will have to be bought. (Additionally, a higher wear and tear on existing trucks due to higher loads means higher replacement revenue)

There’s also been increase in input costs (steel, crude etc.) which have since reversed, so as the air clears, we should see more activity all around.

The point here is simple: India’s in the early stages of vehicle acceptance. Regardless of Ubers and Olas and Zoomcars, we believe that a lot of India will need personal cars and two wheelers – and there are over 1 crore people joining the workforce each year, for one, and there’s a serious lack of public or rural transportation infrastructure, for another. The story remains strong for the next 10 years, though it will have blips like we have now. We have to think of where the market will go, and today’s challenges will provide us a cheaper access to stories of tomorrow.

Is There Growth?

Despite the general feeling of a slowdown, our companies have reported average earnings growth of 16% (so far) in the December quarter. Even the NBFCs and financials have given us an average growth of 22% year on year, which in the face of the liquidity challenges has been better than we expected.

The portfolio is still a bottomup portfolio but we have added more consumer stories, now that they are cheaper. The idea is to participate in what India will use in the years to come – from finance, to vehicles, to consumer brands, to basic infrastructure, to even technology exporters building technology for electric and autonomous cars. The current prices are actually quite exciting for us to be buyers.

Even then, we believe the next few months are likely to remain lowkey as elections have kept people from investing back into markets in a large way. Foreign investors have been iffy, and domestic investors haven’t added more to their investments, so until there’s better sentiment, the market won’t exactly fly. There’s fears about China, US Trade wars, Brexit and what not – but in general, we find that as these pieces get fixed, sentiment will reverse as well. If there was a tradesettlement between the US and China today, the world markets would suddenly get excited, for instance.

The Divergent Markets

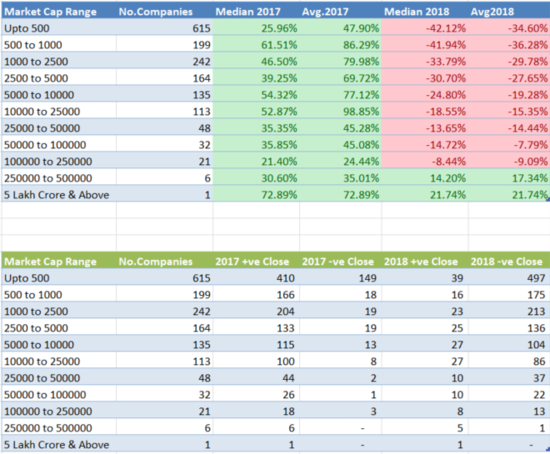

And what’s happening now is perhaps the most obstinately divergent market we have seen in a while. Since 2012, we have not seen a situation where the broad market (read: beyond the top 10 stocks or so) has been in such doom and gloom. In 2018, it was a very small set of stocks – those with market caps of 250,000 cr. Or more – that drove the market entirely, lookin at the returns:

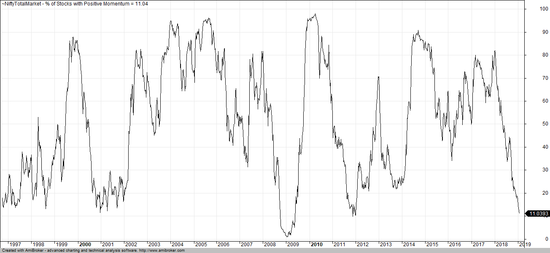

Let’s also see the percentage of stocks in the market that are trending downwards versus upwards:

Every time this number has fallen to below 15% it’s been a great time to pick stocks and wait.

There’s an RBI meeting soon, and it’s quite likely we will set a path for lower interest rates in the future. We’re having a liquidity crisis for NBFCs whose cost of capital has risen, and in India banks are quite lazy and restricted, so much of the lending still originates at nonbanks. With inflation at multi year lows, we are likely to have to cut rates – because inflation at sub 3%, and interest rates at 7% make very little longer term sense. There’s also this fear of elections. But our point is: Will a new government – whoever it may be – come and derail everything? If anything, just the fact that we’re done with the political craziness should eventually provide a sigh of relief. Regardless of what happens, we believe India will continue to grow – even at 3% inflation and 7% real growth, that means a nominal growth of 10% a year. And that translates to about 18 lakh crore rupees of new value being created every year. That’s $240 billion a year, which by itself would be in the top 50 GDP countries in the world. We add, with our growth, the equivalent of a European nation like the Czech Republic each year. It’s going to be tough for any political party to dramatically reduce that. We’re looking forward to whatever happens.

As the next few months come along, we intend to change our allocations to stocks based on our analysis of growth, but we retain a long term focus on nearly all the positions we have. We recently added a housing finance company as a proxy to buying into a Bank they are merging with. While the market hasn’t liked it just yet, there’s big potential for growth as the bank has excellent financial performance, a low cost of funds and has demonstrated the ability to scale income rapidly.

We also added a consumer player in the home insecticides sector, for its presence in growing countries (Africa/Asia/South America) and the strong market in India. This will again take its time to give us great returns but the geographical presence and focus on margins gives us the confidence it will scale well in the coming years.

For many of you we have now made it easier to add more investments via the online progress portal (https://progress.capitalmindwealth.com) and you can use either bank transfers (through NEFT or online), or set up a bank mandate to have an automated transfer every month. Please contact akanksha@capitalmind.in for more details.

In other news, we have moved to a new office! This is a better, single floor office, in HSR Layout in Bangalore, and we would love if you can drop in and visit! Our address is below, and you can see the Google Map link here.

Smelling of Fresh Paint,

Deepak Shenoy