Election Results, Debt Jitters and New Opportunities Make an Interesting May

When investors get spooked, mutual fund managers have to sell their debt, which means more trouble for those that depended on mutual funds to provide them debt capital.

It’s election season! Just as we decide, as a country, who gets to tax us for the next five years, we also have some economic ramifications in the near and long term. The main questions are:

- Will there be a majority by one party?

- If not a majority at least a limited coalition?

- Or will it be a hung parliament?

These are good questions. Because a political standoff may mean a few bad things - an attempt to ruin economic stability for the sake of populism. So we could get a higher tax regime if they want to provide for basic income for everyone. We could get much higher government borrowing which will increase interest rates for us.

However, the presence of a majority has also not stopped economically dangerous policies such as banning of certain notes, so we might as well say that it doesn’t matter what happens and which party comes to power: India will chug on regardless.

India has, even in the past. Some of the most glorious days of the stock market were between 2004 and 2007, when the markets went up nearly 4 times. At the time, among the people in a coalition government were the Left parties - who are the least likely to give market participants happiness, you would think. Yet, that’s what happened.

India’s a juggernaut, really. We aren’t as driven anymore by central government policies. Of course, there is some impact, but it’s low. At some level, India grows despite its politics. Every little we grow, millions of people come out of poverty - and when they do, they become customers for services and products that help growth a little more, and then a few millions more come out of poverty. It’s a strong cycle only because we have so many people still poor.

We had the rise of a Flipkart, a Swiggy, a Zomato, an Ola and an Oyo, all with their foreign counterparts, in the last few years - all of these companies have taken no government concessions. They take all the losses for themselves, while paying solid money for their driver/delivery/vendor ecosystem, and still, keeping costs for customers low. At some point, the drive for capitalism kicks in, and instead of raising prices, these companies just sell themselves to each other, or to some other player who’s mostly missed the bus so far, and the losses continue. We don’t know how long it will last, but it’s quite likely that no matter what government comes to power, they will continue to thrive, lose money and keep our costs low.

On the profitable side, there are solid businesses too that don’t need government largesse anymore. While we used to provide the IT giants with low tax regimes till 2010, now they grow their profits well even when taxed at 33%+. The behemoths of oil and gas are now into telecom and media and content, where government influence is lower. There is now a lot more attention towards buying bad assets in India, from foreign players - without needing to have the government attempt a rescue.

Does this mean there’s no problem at all? Of course not. India has some serious issues right now to grapple with.

The Resurgent Debt Crisis

For one, there’s a debt crisis still going on. Companies in the Essel group (promoters of Zee), Anil Ambani group (ADAG), and the IL&FS group are seeing pressure because they borrowed too much and lenders need to get their money back. These companies are trying to sell assets, a process that takes a lot of time. Not because there aren’t buyers, but because there is promoter hubris - how dare you tell me to sell something I’ve built, just because I can’t pay your pesky debt back? Why don’t you take a haircut instead?

Delaying asset sales will only increase desperation - and by the time these assets come to the market, they may have lost more value. Look at the situation in Jet Airways, where a functional airline could have been sold, at various prices, and even had bidders. By the time the desperation set in, the lenders realised there is nothing left.

The debt issues have increased costs for many non-banking financiers, some of whom face a crisis of existence and have nearly shut down fresh lending completely. Resolution will require that either their assets are sold (like IL&FS) or that they are merged to make them stronger (like Indiabulls Housing is attempting, proposing a merger with a bank).

Mutual funds that have invested in debt are seeing downgrades in some of their investments, and that causes them to take a hit on their prices (NAV). This has scared investors in mutual funds too, many of whom did not realize that such an investment might carry a risk. When investors get spooked, mutual fund managers have to sell their debt, which means more trouble for those that depended on mutual funds to provide them debt capital.

Courts are complicating matters too, causing further delays. In many cases, a resolution agreed upon by a majority has been stymied by strange court verdicts, asking for equal status to unsecured creditors with secured ones. In many IL&FS road subsidiaries who have enough money to pay the secured creditors (but not the unsecured ones) courts have said don’t pay anyone at all – with the strange situation that a bank has to declare a loan as an NPA, where the borrower has enough money to pay them, but hey, the court order.

In terms of numbers, everything looks huge now. Jet Airways is, on its own, a 9,000 cr. problem. A financier like DHFL is much larger, with borrowings beyond 100,000 cr. With large numbers like this, with lenders not willing to quickly sell assets, with courts giving difficult orders, what’s to come?

There could be a full blown crisis like we saw in the US in 2009, but even if that does happen, India’s leverage ratios are much lower and there is capability to absorb it. However that does mean losses on the books of many players – banks, mutual fund investors, and many others. The west solved some of it by putting massive amounts of liquidity into the system, and cutting interest rates. India will have to consider something of that sort if matters get worse.

But more importantly, we expect a large amount of asset sales by Indian companies after elections. Many funds – from Singapore to Abu Dhabi to the US – have set up structures to buy Indian road and other assets, specifically those that have cash flows but can’t function because of the high interest cost. To the foreign player, where interest expectations are much lower, the same project can be profitable if they buy it and charge a lower interest instead. This will still require some haircuts by lenders, but the process of auctions should help find good bids.

The second is the slowdown in growth, specifically in auto. We’ve been looking for a reversal after the twin hits last year, of higher insurance requirements and changed regulatory norms. The commentary by large players indicates lower growth expectations and the numbers on sales reflect some kind of pressure. We’re seeing relatively low growth numbers by all sorts of players including FMCG, consumer durable and other sectors.

But there’s a lot of positives too.

A crisis is good. It flushes out the bad parts of the system. We will take some pain in the financials, see some consolidation and hopefully, asset sales will happen after the elections. For every DHFL we will have a Bajaj Finance type of strong NBFC coming in to take its place. Some of these assets, from road projects to power, will start operating after they are sold, and work their way into our growth.

We’ve seen this play out in some way. Bhushan Steel was bought by Tata Steel in a bankruptcy sale, and it has slowly started operations again. We’re seeing Ultratech take over the “bad assets” of JP Cement and slowly increase their capacity utilisation. Even JK Paper (a portfolio company) has restarted production at Sirpur paper, a company it acquired in the bankruptcy process.

India’s inflation has now fallen considerably to below 3%. Once these “bad” assets are sold, more dollars come in from abroad to pay for them, which will add natural liquidity to the Indian system. Post elections, no matter what happens, there will be less uncertainty, and projects will kick off again.

We will see some part of government finances stabilize after the verdict on RBI’s capital – a committee will put its report up after the election results. We believe that will favour the government and give it some money as dividend, as the RBI does have too much capital.

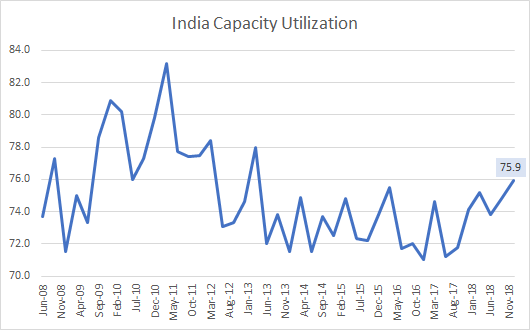

The big thing on the anvil is a return of the capex cycle. India went through massive capacity building between 2010 and 2013, resulting in large loans being taken. Then there was the major NPA crisis which spooked corporates. They refused to expand further, and simply kept using their capacity. As of December 2018, we are seeing the highest utilisation levels since 2013, which means that companies are now reaching close to limits in capacity usage.

We noted this in a post recently:

When utilisation levels get too high, companies have to expand their capacity. This capex expansion means new factories, new offices, and new equipment. The capital goods sector will benefit. A new factory means cement and steel. A new office means more equipment, tables, chairs and furniture. It means more sales of commercial automotives, more electrical goods, more temporary hiring, more services. And to finance this, more corporate loans. Our view is that the next five years see revival of capex, and thus, a set of companies that will benefit.

What we expect to do

Much of this, unfortunately is after election results. We’re keeping some cash handy to participate if markets correct substantially. The top few stocks are very strong, and richly valued – but the rest of the market is at a much more sober levels for a long term investor.

Recently you would have noted some sales in certain stocks. Our exits are to both reduce positions in certain stocks and to change the portfolio. We sold a financial stock recently, primarily because the long term positioning of the company isn’t where we would like to be. While the promoter is excellent, there’s a problem of valuations being too high in comparison with the growth we can now expect to see. There’s more such adjustments coming up. we need to make room for additions in the capital goods space.

We’ve added a bearings company, a real estate player with no effective debt, and a small cap chemical player. Real estate is surprising, you would think, given the trouble in the sector. However, we are seeing the first indications that builders are now ready to cut prices and give discounts in order to sell, and the stronger balance sheets of certain players will help them ride out the price damage.

We’ve recently taken a proxy position in a bank through a housing finance company, and the bank’s results have been spectacular. Valuations are rich, but the opportunity is in a bank at a time when there is distress in their competition, and where it leaves them with room to grow or acquire.

We’ll keep some dry powder for election results on the 23rd, and watch for opportunities out of any panic reactions.

The Index portfolio has done well – better than the long term multi-cap portfolio in April, largely because of the growth in the Nifty and Nasdaq 100. We expect to kick-start the momentum portfolio officially after the election results, and will send a detailed presentation and note for it. You can reallocate part of existing portfolios to this when it comes about, just like in the Index portfolio.

On debt, we remain with short-term funds, but we may be looking to add a government security based fund as well. Our reading of the debt crisis is: there will be a call to cut interest rates even further, and the flight to safety will push more investments in government securities.

We look forward to a much more vibrant stock market in the next few months, and after the uncertainty of election results are done, we believe things for our stocks will start to look better.

To a better democracy,

Deepak